Those who pay attention to politics have rightly been aghast at the stock market’s shameless depravity over the last year, as investors identified the very obvious existential risk to their ability to make money last April, and then they spent the following eight-plus months completely ignoring their own advice. The widespread crash after Trump announced tariffs far higher than the market had priced in was a cathartic moment for politics watchers, in that the bond market yet again proved that the Illuminati are real, and they helped pull TACO Trump back from the brink. Rationality had prevailed in the wake of stunning ignorance. In a logical world, one might assume that a singular event where one man wiped out trillions in wealth with one hastily thrown together Excel sheet would get traders to reconsider their outlook on the markets, but we don’t live in a logical world.

We live in the zero date options YOLO Trump world, where tomorrow only matters insofar as to whether it will exist so you can exploit it for cash. The day after tomorrow is forever and a day away, and that old average of investors holding stocks for seven years before selling them feels like another universe. As I have written before, the stock market is this way because the marginal buyer in the stock market looks a lot like the marginal buyer in crypto. Logic is always something that can be put off for another day, because as the saying goes, the market can stay irrational longer than you can stay solvent. That is the short story of everyone’s losing Tesla shorts.

So as Trump stripped the country for parts and rooted new inflationary pressures in the economy that we can already see in the data, the stock market rose to all-time highs last year. All while the bond market warped itself bouncing around trying to figure out whether inflation or deflation was its bigger concern (there’s a word for the middle of that conundrum!). Bonds are where politics intersect with markets, because bonds are how governments fund themselves, and the story that long-term interest rates are telling right now is harrowing.

Trump’s War On The Price of Money

As someone who dreaded all my bond market classes in my master’s program I took alongside Splinter‘s launch, I understand how confusingly opaque they can seem, but all you need to know is that a bond is just a loan. You give Apple or the United States government $100 right now, and they will pay it back to you in 10 years, plus regular payments at 4.279% interest, according to the 10-year Note as of this writing. The biggest buyers are typically the major players in the financial world, like pension funds, insurance companies, banks and hedge funds (hedge funds run a leverage scheme on top of them, which is a neat little risk to attach to what the financial world deems “risk-free” money).

Treasury yields determine the interest rates you pay on your credit card, mortgage, and other debt. It is a striking commentary on our financial press that they focus so much on the stock market, and not the largest, most liquid market in the world that quite literally puts a price on money every day. Interest rates reflect the risk you need to be compensated for in order to loan someone money over a period of time, and if you are looking at this lunatic below and saying that you need a higher interest rate to compensate for the risk that he may not pay you back, you are not alone.

Trump is now confusing Greenland and Iceland: “They’re not there for us on Iceland, that I can tell you. Our stock market took the first dip yesterday because of Iceland. So Iceland has already cost us a lot of money.”

— Aaron Rupar (@atrupar.com) January 21, 2026 at 7:20 AM

Trump has genuinely declared war on the very concept of interest rates. This man is not well, and the bond market knows it. The Federal Reserve cut the Fed Funds Rate by 25 bps (0.25%) on December 10th, a small example of what Trump wants to do on a grander and more irresponsible scale. He wants to slash the Fed Funds Rate down from around 3.5% to 1% or lower because he thinks that he has unilateral control over the whole world. While Treasury Bond rates do typically follow the Fed Funds Rate, they only follow the Fed when the bond market believes that the traditionally independent Fed is doing the right thing, and that inflation is low enough to justify the Fed cutting rates. The 1970s taught us that if you cut rates too quickly, inflation can come roaring back, forcing you to raise interest rates even higher than they were before in order to tame inflation, creating a vicious stagflationary feedback loop that spawned the hell on America known as Ronald Reagan and his party of modern know nothings. The Fed has been very clear that they do not want to repeat these generation-defining mistakes, and they want to be patient and wait to see if the data justifies lowering rates first. Patience is a word that is anathema to America’s King toddler and his cult of lemmings, so the subtext of all U.S. interest rates everywhere recently is a fear of Trump making inflation great again.

Treasuries have diverged with the Fed Funds Rate ever since the December 10th cut, as Trump has stepped up his attacks on the Fed’s independence. The two-year U.S. Treasury yield is up around 1.4% since 12/10. The five-year is up about 2.6%. The ten-year is up a little over 3%, while the 20- and 30-year Treasury Bonds are up around 2.3%. This is the exact opposite of what the Fed wants to see, and a lot of this move has taken place in the last two days, coinciding with Trump’s insistence that the United States seize Greenland from Denmark. It can be dismaying as a political watcher to see this madness go unpunished in a broken country overflowing with universally corrupt, bigoted and cowardly Charmin-soft elites, but this is where the boring old bond market can actually be of cold comfort. He is being punished for this assault on Europe, you can see it very clearly on the charts. But unfortunately, you are going to have to pay for it.

Long-term borrowing costs are rising around the world, as demand for long-term government debt has been waning in recent times. Unfortunately, the deficit scolds have a point, and governments everywhere are all on unsustainable long-term fiscal tracks. Deficits did not matter as much in the era of zero interest rate policy (ZIRP) where debt servicing didn’t cost anything, but now that we pay more on interest on the debt than we do for the fucking Pentagon ($1.1 trillion in interest expense in 2024), I’d say it’s a pretty big issue now. It’s a simple math problem. It used to be 0% times a lot, now it’s 3% to 4% times a lot, and Trump’s so-called big, beautiful bill blew out the deficit even further, forcing the last remaining holdout among the ratings agencies to join their brethren and downgrade American debt. Moody’s downgraded our credit rating from triple-A to Aa1, and changed their outlook from stable to negative last summer as a warning to the GOP that went unheeded. Measuring from the month the bill was passed in May 2025 to now, the 30-year yield is up 5.43%.

But the bigger problem beyond America is that long-term interest rates seem to be only traveling in one direction around the entire world, which brings us to the biggest event that shook markets yesterday. It was not Trump’s posting madness, but an unprecedented move in Japanese bond yields.

Japan Is No Longer Serving a Free Lunch

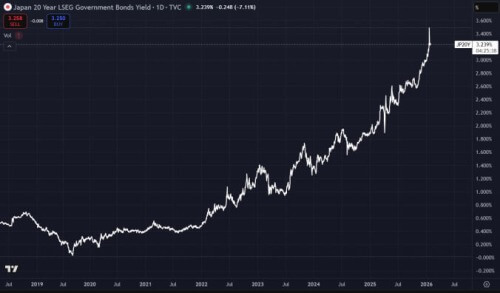

The long end of the Japanese yield curve completely blew out yesterday. It went beyond sober finance-speak, and is far better defined by cartoonesque descriptions like kapow, kablam, or kablooey, even. Yields on the 20-, 30-, and 40-year bonds exploded like a shitcoin, painting a truly harrowing picture on the chart detailing Japan’s borrowing costs. The scale of these moves are bad enough, but to see the upward trend since 2020 adds to the notion that this is not some outlier event. The rules of global finance may have fundamentally changed this week.

Chart of 20-year Japanese Government Bond Yield via TradingView

There is a reason this happened, and it’s politics. New Japanese Prime Minister Sanae Takaichi called for snap elections on February 8th, an attempt to consolidate her power in parliament. She is extremely popular, and the expectation seems to be that her Liberal Democratic Party will win, and she will pass a slate of new reforms. She has promised a two-year suspension of a tax on food, which will cost the government an estimated 5 trillion yen ($32 billion). She also is attempting to pass a $132 billion stimulus package, doing the two things the bond vigilantes hate the most, and sapping the entity they’re lending money to of money.

But as the chart above demonstrates, the bond market has long been worrying about Japan since 2020. They are an anchor for global finance, and their monetary and fiscal policy has been united around betting the Japanese farm on American debt while doing everything they can to keep their own interest rates as low as possible. When you can pay your own debts, you can afford to goof around with the price of money like Japan has for decades, but when your biggest financial partner has lost its fucking mind and you are staring down the barrel of your own staggering 236% debt to GDP ratio, investors are going to get nervous. They’re going to demand a higher yield to justify lending you money, and that’s why Japan’s interest rates were rising well before Takaichi entered office and told bond investors that she’s going to run the country deeper into debt.

She has promised to deploy “strategic fiscal measures,” and Japan has proven that their ingenuity in that regard should never be doubted, but this is a brand-new world she is trying to usher her formerly artificially low-interest rate country into. For decades, Japan has acted as something of a volatility anchor in global finance by suppressing interest rates, enabling investors to borrow for free in yen, then use the low volatility in the yen to convert it to their preferred currency to buy assets that appreciate in value. Rinse and repeat and get rich for free as the magic of ZIRP drives asset values up everywhere. This has been a huge boon to tech stocks and other long duration assets especially, and that is what is known as the “Japan carry trade” in the United States. It has such immense importance to the U.S. stock market that some mechanical noise in the trade that caused traders to reposition around it in August 2024 caused the third largest spike in the VIX’s history, a volatility measure that generally reflects when the shit is seriously hitting the fan, demonstrated by the only two higher spikes coming in 2008 and 2020.

Japan is very, very important to the global price of money and assets everywhere, and now they seem to be on a path to elevated interest rates. How high they go is anyone’s guess, we are just three days removed from the weak auction for the Japan 20-year bond that sparked this parabolic move up in long-term yields. But the message from the bond market to the Japanese government is clear: investors are going to demand higher interest rates to lend to a government deeply in debt who is likely to go even further into it after February 8th. That has grave implications for the rest of the world who has been dining on Japan’s free lunch for ages.

The Very Not Good Long-Term Trend We’re On

Up only. That’s not just an ethos for the moonbois populating the stock market these days, but for the long-term yields demanded by the sober investors in the bond markets. No government anywhere has their fiscal house in order, and the concept of a safe haven may be a relic of a more orderly past. Debt to GDP ratios across the western world are also up only and rising above 100%, and I am very concerned that interest rates are becoming unmoored from the ZIRP-driven status quo that defined most of the 2000s prior to the inflation shock of late 2021. This will create its own kind of dramatic shock to stock markets still stuck in ZIRP la la land, because the price of money might have permanently gone up for a generation under their noses while they all got distracted by chatbots that lie to you and encourage young people to commit suicide.

If investors demand a higher interest rate to lend to governments, then governments will have to spend more money to service their growing debts. That will in turn degrade the value of their debts because more government receipts are being wasted on paying interest to the investors lending money to them. This will further push up future long-term borrowing costs because there’s even less money now to service rising debts, creating a vicious feedback loop of rising rates and slowing growth. This matters to you because the 30-year Treasury Bond is how your mortgage is determined, and this is the lone area of the world where trickle-down economics actually does take place, as long-term borrowing costs inform shorter-term borrowing costs.

The global financial rules seemed to have changed in a pretty dramatic way this week. The United States is very clearly no longer a trusted partner to Canada or Europe, and economic warfare between the globe’s largest economies seems likelier by the day as America’s mad King spirals out of control, farting out new and unseen existential threats every week. It’s really not a stretch to say that the host of The Apprentice may crash the global economy and plunge us into a generational depression all because of the Mercator Projection.

But Japan is a massive story. Frankly, right now, it’s more important to markets than Trump’s latest bout of madness. The last low-interest rate regime in the major financial world may have died for good this week, ending the last free lunch in finance. That has profound implications for liquidity in markets around the world, and while the very definition of an economic crisis is one centered around surprise and unpredictability, the lone commonality they all have is a liquidity shock to spark the snowball rolling down the hill.

The joke in finance used to be that you could have a great idea to make 40% on a gold trade, you just have to wait a decade for it to play out. Precious metals like gold and silver have very different dynamics than stocks, as central bank purchases and sales create an entirely different dynamic than what have become purely speculative assets in the S&P 500. But since the start of 2025, gold is up a staggering 85%. DXY, a dollar index measured against primarily the euro and yen, is down about 9% since 2025, while the 30-year U.S. Treasury Bond is up 2.6%. The story that tells is “sell America,” the hottest trade in the market since Trump took office. The stock market is really in its own world, proving itself to be almost as detached from reality as Trump’s melting brain is right now, and I keep hearing my finance professor’s words from spring 2024 ringing in my head, as she pointed to a laughably high CAPE ratio for the market and said, “I just think people are gonna get killed.”

The Shiller PE, or CAPE Ratio, is just a price to earnings ratio for the entire market, based on average inflation-adjusted earnings from the previous 10 years. In layman’s terms, it’s a gold standard measure to tell you how expensive a market is relative to the actual fucking money it makes. This is almost the most expensive stock market in history by that measure, second only to the dot com peak. “I calculate that a market correction of the same magnitude as the dotcom crash could wipe out over $20 [trillion (trn)] in wealth for American households, equivalent to roughly 70% of American GDP in 2024” wrote Gita Gopinath in The Economist, former chief economist of the IMF. “The global fallout would be similarly severe. Foreign investors could face wealth losses exceeding $15trn, or about 20% of the rest of the world’s GDP. For comparison, the dotcom crash resulted in foreign losses of around $2trn, roughly $4trn in today’s money and less than 10% of the rest of the world’s GDP at the time,” she continued. “This stark increase in spillovers underscores how vulnerable global demand is to shocks originating in America.”

It’s difficult to not feel like Trump is barreling us head-on into a global economic crash on the scale of 2008 or larger, and perpetual doomer Ray Dalio may be right for once with his theory of 100-year boom and bust capitalist cycles (what’s 1929 plus 100?). Like 2008 revealed, shameless fraud defines so much of the world these days, and the lesson no one learned in 2008 is that in that world, one day everyone will wake up and not know what anything is actually worth, and they will freak the fuck out. Now there is a harrowing alignment in bond markets centered around demanding higher and higher interest rates to lend to governments who have proven themselves unable to get their fiscal houses in order after ZIRP provided them with a generational opportunity to do it at low cost. Japan’s free lunch seems to be gone as long as Takaichi is wielding her power to try to address the country’s affordability issues, and there really is nowhere “risk-free” for global investors to turn, which is why you have seen gold run like crazy this past year.

In a world filled with madmen and their enablers who have kicked the globe’s biggest cans down the road, people know that eventually those cans become too large to kick without breaking something, and now we can all see them looming over the horizon. It’s clear at this debt-laden point in the globe’s financial history that the only way we could deviate from this path of higher and higher long-term interest rates is through responsible and imaginative leadership, or a dramatic economic crash justifying Trump’s desire to drop rates below 1%. I know which one I’m placing my Kalshi bets on.