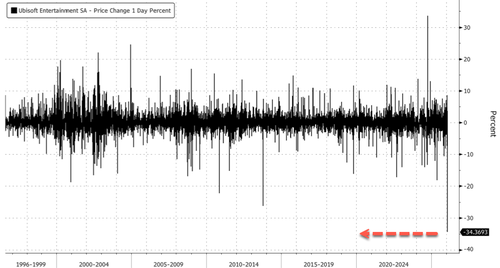

Ubisoft Entertainment SA shares in Paris crashed the most on record after the maker of Tom Clancy's Rainbow Six Siege (more commonly known for Assassin's Creed) announced widespread restructuring, studio closures, project cancellations, and sharply lower guidance.

Shares plunged as much as 36% in the intraday session, currently down 33%, the steepest drop on record.

Shares are down to around 2011 lows. Will the 2002 lows be next?

The French gaming company said it expects a 1 billion euro EBIT loss in FY 2025-26, driven by a one-off 650 million euro writedown tied to the restructuring. It will close studios in Stockholm and Halifax, cut about 100 million euros in fixed costs by March (a year ahead of plan), and target an additional 200 million in cuts over the next few years.

Six games were canceled and seven delayed, including the long-awaited Prince of Persia: The Sands of Time remake, prompting some Wall Street analysts to warn of a broken game development pipeline.

Key summary of Ubisoft's year forecast (courtsey of Bloomberg):

-

Sees net bookings about EU1.5 billion, estimate EU1.78 billion (Bloomberg Consensus)

-

Sees negative free cash flow EU400 million to EU500 million

-

Sees non-IFRS Ebit loss about EU1 billion

-

In November, Ubisoft said "it expects stable net bookings year-on-year, approximately break-even non-IFRS operating income and negative free cash flow"

Third quarter forecast:

- Sees net bookings about EU330 million, saw about EU305 million

Ubisoft's new structure will comprise five "creative houses," business units each handling a game genre with "faster, decentralized decision-making," the company explained. In April, these units will be supported by a network of studios providing development resources - and will all share core resources.

"The portfolio refocus will have a significant impact on the Group's short-term financial trajectory, particularly in fiscal years 2026 and 2027, but this reset will strengthen the Group and enable it to renew with sustainable growth and robust cash generation," Yves Guillemot, Founder and CEO of Ubisoft, wrote in a statement.

Here's commentary from Wall Street analysts (courtsey of Bloomberg):

Bernstein (market perform)

Management refrained from outlining any FY27 indications, "but we felt that a return to positive FCF may well be a three-year journey as Ubisoft strives to right-size its cost base," analyst Aleksander Peterc writes

This could turn out to be a survival test, given about €1b of debt is due in 2027 and 2028

TD Cowen (hold)

"We are skeptical that the reorg will fix long-standing issues with inconsistent game development," analyst Doug Creutz writes

It's not clear why the new model after the restructuring will achieve superior results compared with the old one, which produced aggregate negative Ebit over seven years

CIC (downgrades to sell from neutral, PT lowered to €4 from €7.5)

The update points to a worsening operational situation, with the prospect of significant cash burn in FY26 and probably FY27, according to analyst Eric Ravary

The reorganization seems to be paving way for IP and studio disposals

Most of the firm value is tied in its JV with Tencent

Kepler Cheuvreux (reduce, PT cut to €5 from €7)

Broker's previous cautious view was based on operational challenges and added complexity from the Tencent transaction, while assuming balance-sheet risk remained largely under control

These latest developments should bring balance-sheet risk back to the forefront of the investment thesis

The key question is if Ubisoft shares find a base at the 2011 lows or ultimately retrace toward the 2002 trough. With restructuring now underway, focus shifts to whether the company can stabilize operations and rebuild after crashing and burning. This is a stock to watch over the next 12 to 24 months.