Bank of America upgraded Oklo from Neutral to Buy following Meta’s recent, massive nuclear deal. According to the BofA report (available to pro subs), Meta's agreement with the hyperscaler provides investors with “tangible evidence advanced nuclear is moving from concept to execution.”

Meta prepaid $25 million for Phase 1 of Oklo‘s nuclear campus construction in Ohio for approximately 150 MW of energy. The funding is expected to be used for fuel procurement, site preparation, and early development ahead of final PPAs.

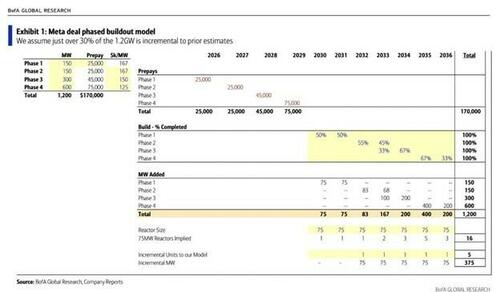

With 16 reactors expected to come online between 2030 and 2036, this drives BofA’s 2036 targets to $5.9 billion in revenue (vs. $5.5 billion prior), 117 units (vs. 111 prior), and 6.7 GW deployed (vs. 6.3 GW prior), leading to a price target of $127, up from $111 prior.

BofA analyst Dimple Gosai, who covers US cleantech at the bank, highlights the sequencing of a ramp to 1.2 GW thanks to the Meta deal, which moves “Oklo‘s opportunity set from ‘conceptual’ to ‘actively financed’ development.”

The bank also expects longer-dated cashflow thanks to continued progress on fuel supply and licensing. Specifically for the Ohio nuclear campus, Phase 1 is projected at 150 MW from two reactors online in 2030/31, Phase 2 adding two more reactors in 2032/33, Phase 3 adding four reactors in 2033/34, and finally Phase 4 adding eight reactors in 2035/36.

BofA has yet to take into account any of the fuel recycling potential with regards to the mega-project announced for Tennessee. The campus in Tennessee is expected to include recycling and reprocessing facilities to convert used nuclear fuel from traditional reactors into fuel for Oklo‘s fast-spectrum Aurora reactors, as well as process plutonium for use in their Pluto reactor design. Pluto reactors are expected to be deployed at the recycling site in Tennessee as well.

Oklo also has multiple other projects, including the Air Force has in Alaska and likely many other hyperscaler deals on the horizon.

Not long ago, OpenAI boss Sam Altman left Oklo's board to preclude any conflicts of interest, hinting at a possible deal on the horizon with OpenAI.

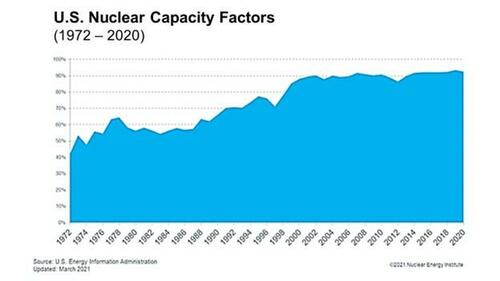

The positive news still need to be counterbalanced with potential construction and operation headaches of these novel reactor designs. While it is not the first time the US has constructed sodium reactors, the time it takes to achieve operational proficiency and maintain availability greater than 90%, similar to the current commercial fleet, could take years or even decades.

More in the full note available to pro subs.