Asian and European stocks, along with US equity index futures, are deeply in the red this morning as tensions between President Trump and Europe intensify over Greenland.

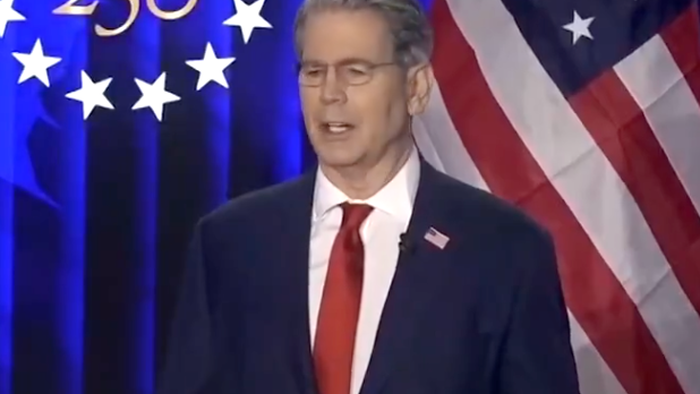

At the annual World Economic Forum in Davos earlier, Treasury Secretary Scott Bessent urged calm on the Greenland issue. He also said the next Federal Reserve chair could be announced as early as next week.

"I am confident that the leaders will not escalate, and that this will work out in a manner that ends up in a very good place," Bessent told reporters at a press conference.

Bessent called the uproar over Greenland "hysteria" that was very similar to the narrative chaos produced by corporate media headlines in April of last year, surrounding President Trump's tit-for-tat trade war with top trading partners.

"This is the same kind of hysteria that we heard on April 2," Bessent said. "There was a panic. And what I'm urging everyone here to do is sit back, take a deep breath, and let things play out."

Asked about Europe dumping US treasuries, a potential economic weapon used by Brussels to combat Trump, Bessent dismissed that speculation as a "false narrative."

"Sit back, take a deep breath, and let things play out."

— Bloomberg (@business) January 20, 2026

Treasury Secretary Scott Bessent urges countries to stick with their trade deals and not escalate against the United States https://t.co/ccfNCPbXBs pic.twitter.com/AK3XX9ai8d

Bessent said the US Treasury market is "the best-performing market in the world" and the "most liquid" debt market in the world. He expected Europeans to hold their current exposure, not offload it.

"There's a completely false narrative there," he said. "I think everyone needs to take a deep breath. Do not listen to the media, who are hysterical," adding, "It defies any logic, and I could not disagree more strongly on that."

Over the weekend, President Trump said that Britain, Denmark, Finland, France, Germany, the Netherlands, Norway, and Sweden would be subject to a 10% tariff on all goods shipped to the US until Denmark agrees to cede Greenland.

Swissquote analyst Ipek Ozkardeskaya pointed out, "Europeans hold roughly $10 trillion in US assets: around $6 trillion in US equities and roughly $4 trillion in Treasuries and other bonds. Selling those assets would pull the rug from under US markets."

In markets, UBS analyst Justinus Steinhorst said, "Sell America Trade is re-accelerating; week to date the dollar index is 85bp lower whilst Gold has added 2.7%. The US 10y has broken out above its 200DMA for the first time in months."

Simon Penn from UBS also said, "Sell America is back on - all of US equities, Treasuries, and the dollar are under downward pressure."

Penn noted:

Until last April's initial tariff threats, that had never happened before. The S&P Emini is down 1.4% since Friday's close, the US 10y yield has added 4bp, and the DXY down 0.4% from Friday's close. Not only because of the latest tariff threats related to Greenland, but also because one of the pillars of this year's US economic outlook – more cuts from the Fed, is now being questioned by the markets on chair uncertainty. Note that the 10y yield has added 13bp in the last three trading sessions – a greater range that it had experienced in the prior eight weeks. It's back to where it was in the middle of last August.

"What President Trump is threatening on Greenland is very different than the other trade deals, so I would urge all countries to stick with their trade deals. We have agreed on them, and it does provide great certainty," Bessent noted. He reaffirmed the US commitment to NATO, saying that US membership in the security bloc was "unquestioned." "That does not mean we cannot have disagreements on the future of Greenland," he concluded.