Le Journal

"If You Say No, We Will Remember" - Trump Demands "Immediate Negotiations" But Rules Out Greenland Invasion

Powell To Attend As Supreme Court To Review Trump's Firing Of Fed Governor Lisa Cook

Police Use Tear Gas, Stun Grenades Against Farmers Protesting Mercosur Trade Agreement At EU Parliament In Strasbourg

US NatGas Poised For Biggest Weekly Spike On Record As "Blizzard Of '96" Fears Resurface

Futures Slide To Session Low As Bounce Fizzles With All Eyes On Trump In Davos

Futures Slide To Session Low As Bounce Fizzles With All Eyes On Trump In Davos Futures have reversed modest overnight gains and are trading near session lows while small caps continue to outperform (for a record 12th day in a row) even as Japanese and global bond yields stabilize and the market awaits today's major catalysts including Trump's speech in Davos due within the hour after flight had to be changed due to mechanical issues, while the Supreme Court will consider whether Trump can fire the Fed’s Cook.Selling pressure initially eased after Trump struck a more conciliatory tone ahead of his departure for the World Economic Forum, even as he continued to insist the US should take control of the Danish territory. As of 8:00am, S&P futures are down 0.1%, while Nasdaq futures drop 0.3% with Mag7 names mixed in premarket trading, semis are bid; discretionary leading Staples; energy / mats seeing significant outperformance. Bond yields are 1-2bp lower and USD is once again lower on the day. Commodities are seeing strength in ags, natgas and precious, with gold approaching a record high at 4,900 The macro focus today is Davos and housing related data. In premarket trading, Magnificent Seven stocks are mostly lower (Nvidia +0.1%, Meta +0.01%, Tesla -0.2%, Amazon -0.3%, Microsoft -0.3%, Alphabet -0.9%, Apple -0.2%) Biohaven (BHVN) rises 3% after RBC upgraded the drugmaker to outperform, citing recent supportive data that reduces risk. Halliburton (HAL) climbs 2% after the fracking company reported fourth-quarter adjusted earnings per share that beat the average analyst estimate. Johnson & Johnson (JNJ) falls 1% after posting fourth-quarter sales. Kraft Heinz (KHC) declines 5% as Berkshire Hathaway may soon sell some or all of its stake in the company, just months after the cheese and ketchup maker announced plans to split into two. Nathan’s Famous (NATH) rises 8% as Smithfield Foods agreed to buy the company for $102 a share. Netflix (NFLX) falls 7% after the streaming giant forecast first-quarter earnings below the average analyst estimate. The company also plans to pause its share buybacks in an effort to accumulate cash to fund the pending acquisition of Warner Bros. Progress Software (PRGS) rises 6% after the company’s 2026 revenue forecast exceeded Wall Street expectations. United Airlines (UAL) rises 3% after the carrier beat Wall Street estimates for the fourth quarter and anticipates a strong 2026, driven by demand from high-spending domestic passengers and international travelers. In corporate news, Qatar’s sovereign wealth fund is said to have considered separating its overseas holdings from its domestic portfolio. Kraft Heinz is lower in premarket trading after registering up to 325 million shares held by Berkshire Hathaway for potential sale. The market's mood remains extremely shaky (and even more illiquid with top of book collapsing 60% overnight according to Goldman) with gold continuing to hit new highs. JPMorgan AM CIO Bob Michele said Tuesday’s market selloff should be a message to Trump to take action to restore calm. Still, the moves weren’t nearly as dramatic as April’s selloff, leaving the TACO trade with a problem: If TACO means investors don’t need to panic, then there are no market collapses violent enough to spook Trump into backing down. Meanwhile, Trump expressed confidence that the EU would continue to invest in the US even if he imposed new tariffs related to his quest to annex Greenland. He is due to speak in Davos at 8:30 a.m. New York time, though his travel was delayed after an electrical issue with Air Force One. His threat of tariffs in pursuit of Greenland, and refusal to rule out military options, are giving the equity bull run its biggest test since the trade turmoil of April, even as investor optimism remains elevated amid a broadening rally. Sill, selling pressure initially eased after Trump struck a more conciliatory tone ahead of his departure for the World Economic Forum, even as he…

After Trump Meeting, Slovak PM Fico Says 'EU Is Not Taken Seriously' By World Leaders

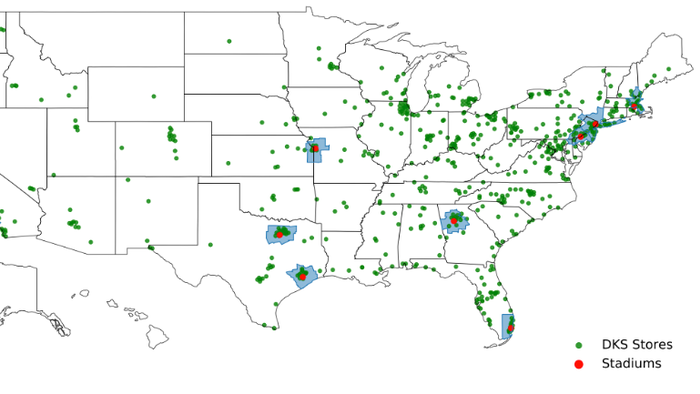

World Cup Lift: Goldman Forecasts Retailers' Potential Bounce From The 'Beautiful Game'

Despite Mass Protests, UK Approves Controversial Chinese Mega-Embassy In London

Despite Mass Protests, UK Approves Controversial Chinese Mega-Embassy In London Authored by Evgenia Filimianova via The Epoch Times (emphasis ours), Despite a weekend protest, the UK has approved plans for a new, significantly expanded Chinese embassy in central London, ending a planning dispute and overriding objections from local authorities and lawmakers who raised national security concerns. An exterior view of the proposed site for the new Chinese Embassy, near Tower Bridge in London on June 23, 2023. Hannah McKay/Reuters The Chinese communist regime purchased the Royal Mint Court site in 2018 and plans to convert it into a much larger embassy than its existing building in London. The site is located in the City of London, the capital’s financial district. Tower Hamlets Council rejected China’s initial planning application in 2022, citing concerns about security, scale, and local impact. A revised application was submitted in July 2024, shortly after the Labour Party entered government. The site for the proposed embassy lies close to major data cables and financial infrastructure that underpin the UK’s banking and communications systems, a factor that featured heavily in parliamentary objections Approval was granted on Jan. 20 by Secretary of State for Housing, Communities and Local Government Steve Reed. The UK’s domestic and foreign intelligence agencies said security risks linked to the new embassy could not be fully eliminated, but could be managed through mitigation measures. In a joint letter to Home Secretary Shabana Mahmood and Foreign Secretary Yvette Cooper, MI5 Director General Ken McCallum and GCHQ’s Director Anne Keast-Butler said it was “not realistic to expect to be able wholly to eliminate each and every potential risk.” The intelligence chiefs added that the work to develop a package of national security mitigations for the Royal Mint Court site had been proportionate. Reed said in a Jan. 20 statement that the decision is final unless overturned by a court challenge. He said the approval was based on the recommendation of an independent planning inspector who held a public inquiry between Feb. 11 and Feb. 19, 2025. Political Backlash Opposition lawmakers from across the political spectrum criticized the approval. Shadow Secretary of State for Housing, Communities and Local Government James Cleverly from the Conservative Party described it as “a disgraceful act.” The Conservative Party’s shadow secretary of state for culture, media and sport, Nigel Huddleston, said in a Jan. 20 post on X that there were multiple reasons to oppose the project, including heritage concerns, citing historical sites the new embassy will sit atop, including the Royal Mint and a medieval Cistercian abbey. The Liberal Democrats said on Jan. 20 that allowing the embassy to proceed was Prime Minister Keir Starmer’s biggest mistake yet. The party’s foreign affairs spokesman, Calum Miller, said the decision “will amplify China’s surveillance efforts here in the UK and endanger the security of our data.” Protesters outside a proposed site for a new Chinese Embassy in London on Jan. 17, 2026. Dan Kitwood/Getty Images A Reform UK spokesman said the decision to grant the new Chinese embassy planning permission “represents a serious threat to national security.” Baroness Kennedy of the Shaws, a co-chair of the cross-party Inter-Parliamentary Alliance on China, said British lawmakers should take a firmer stance toward Beijing. “Whilst British parliamentarians, like myself, remain unjustly sanctioned and British citizen Jimmy Lai remains imprisoned on political charges, the UK must take a principled stand,” she said. “We cannot reinforce the dangerous notion that Britain will continue to make concessions – such as granting a mega-embassy – without reciprocity or regard for the rule of law.” A UK government spokesperson said on Jan. 20 that intelligence agencies had been involved throughout the process and that national security remained the…

De Beers Cuts Diamond Prices, Botswana Warns Of Prolonged Slump

"Rich Kids Of Iran" Flee To Turkish Nightclubs Amid Deadly Crackdown On Protesters: Report

German Chancellor Merz Admits Shutting Down Nuclear Energy Production Was A "Severe Strategic Mistake"