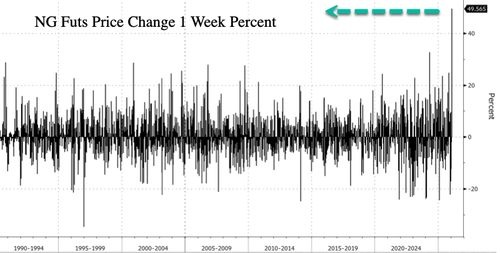

U.S. natural gas futures are on pace for the largest weekly increase on record, according to Bloomberg data spanning more than 35 years.

An Arctic air invasion of the eastern half of the US, combined with the increasing risk of a major winter storm stretching from Texas through the Mid-Atlantic and into the Northeast by this weekend, has triggered sharp upside repricing and panic-style buying in NatGas futures.

As of Wednesday morning, New York NatGas futures are up another 19%. Combined with earlier gains this week, prices have jumped roughly 50% so far. If these gains are sustained through Friday, it would mark the largest weekly increase in NatGas on record, going back to 1990.

The sharp repricing of NatGas futures nearly sent prices to the $5 level earlier in the trading session.

We have documented the incoming cold blast and winter storm threats, with impacts on energy markets in the last five days:

-

NatGas Futs Erupt As Arctic Air Invasion Penetrates Deep Into US South

-

US NatGas Spikes Most Since Ukraine Invasion On Arctic Blast, Major Winter Storm Threat

Ranald Falconer, a derivatives trader at Goldman, provided clients with more color on what could be a historic cold blast for the eastern half of the Lower 48:

Henry Hub on an absolute tear overnight! Front natural gas contracts hit a $4.95 high overnight, peaking just before the London open. The over-riding story here has not changed a great deal, as I mentioned yesterday when looking at Europe, cold weather fronts have been pushed deeper into Jan, and now Feb.

That draw on gas for heating has obviously pushed flat price in Q1 higher, and with it we have seen shorts get stopped out. That isn’t new; I mentioned some sizable Feb/Mar shorts being bought back end of last week, and yesterday similar in TTF. Overnight though, that is one heck of a move! If that is flat price stops in Feb and Mar, it is a strange time of day to put that sort of volume through the screens. I have Feb and Mar trading 3.5x and 4.0x their normal daily accumulated volume at this point.

This note is slightly later than I would have been able to bash it out, but I have had about 6 or 7 separate conversations on the topic with people a lot smarter in the gas world than me. Most poignant comment was that they had not seen such a dramatic change in the weather runs.

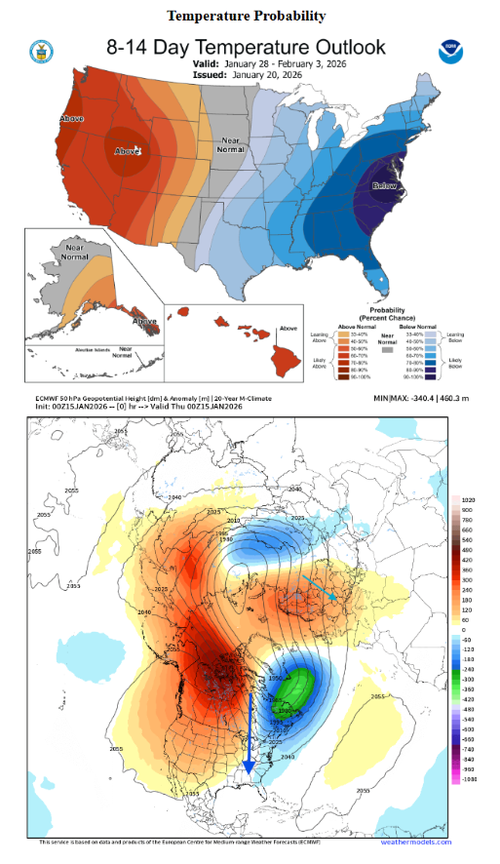

The NOAA chart below is probably the most simplistic way to visualise this without going into the weeds on the vortex and disruption there. Simply put, a strong high pressure area over Northern Canada is stretching the vortex north to south, which displaces the vortex core and causes northerly flow over the Eastern States.

I don’t think I have ever seen that shade of blue on the short term forecasts on NOAA, not sure I would want to be in New York over the next week.

Alongside the cold temperatures, NOAA forecasts frigid cold air to be accompanied by gusty winds taking the wind chill factor into play too. The kicker to the Jan balmo is that these forecasts now stretch into Feb; note that the Euro Weekly data had Feb at max warm in early Feb not that long ago.

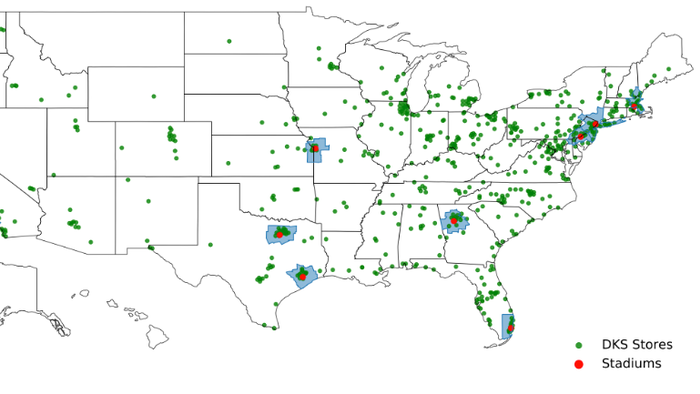

With this spike we will be pricing in LNG shut-in too as export facilities continue to pull feed gas from domestic production, this may now be required for HHDs.

Fundamentally, there has been no disruption that I can see or read, so this is all weather and a severe volume move overnight. It will be interesting to see how positioning in Q2 stacks up as we move into spring forecasts.

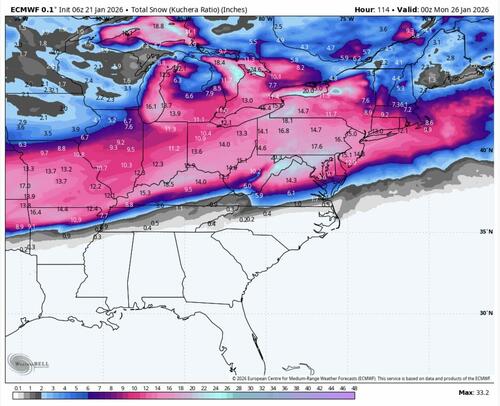

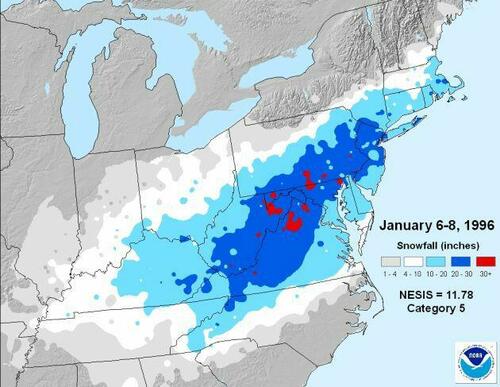

The latest models from private weather forecaster BAMWX of the upcoming storm have some of us reminiscing about the January 1996 blizzard that blanketed the Washington, DC, region with feet of snow...

The January 1996 blizzard:

Stay warm! Prepare.