Le Journal

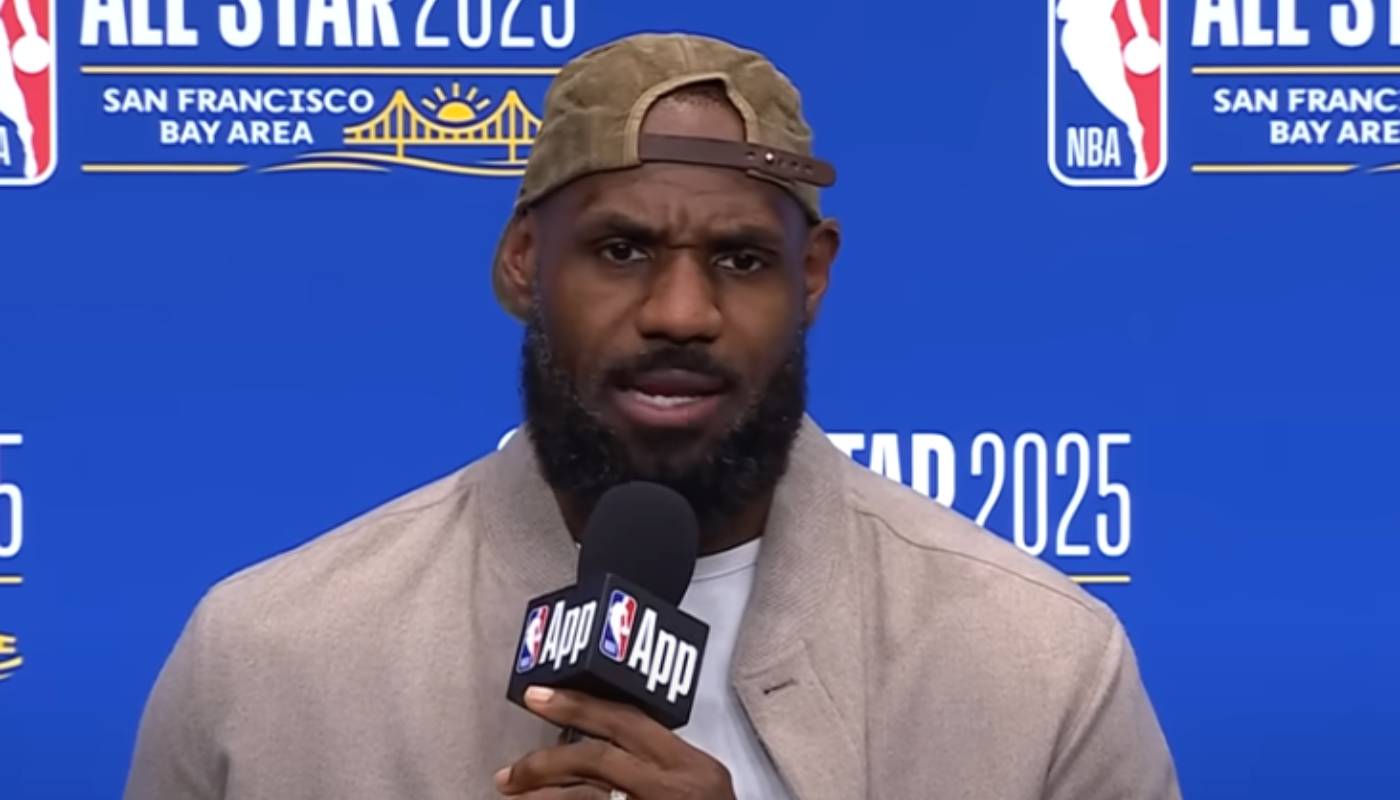

NBA – « Il ne sait pas comment faire » : LeBron James moqué par un ancien coéquipier

Jessica Thivenin : prête à refaire sa vie, elle se confie à cœur ouvert

Commentaires sur UE : nouvelles directives sur les prix minimum des VE chinois par HEB

ON EN VEUX PAS !!

Boulanger multiplie les réductions durant les soldes : les 14 deals à saisir ce weeke-end

Commentaires sur A 46000 euros, la nouvelle berline Xpeng est deux fois moins chère qu’une Tesla S et elle se charge en 12 minutes par HEB

Here's how Goldman Sachs got its swagger back

Jeenah Moon/Bloomberg via Getty ImagesGoldman Sachs posted strong fourth-quarter earnings as dealmaking surged.The firm's stock price is up more than 60% over the past year, far outpacing major rivals.CEO David Solomon says dealmaking levels may soon rival — or exceed — the heyday of 2021.Goldman Sachs is acting like Goldman Sachs again.The Wall Street giant is coming off one of its best years on record, its share price is through the roof, and its executives are downright giddy over its swelling deal pipeline. Equity trading is booming, and dealmaking is thriving ahead of what could be one of the biggest years for IPOs of all time, big boons for Goldman's bottom line.If the bank had lost its luster, CEO David Solomon seems to have gotten it back. Goldman is once again Wall Street's top dog. It's a swift comeback for a firm that some declared dead as recently as 2023. The scars of an internal PR crisis and concerns over Solomon's DJ side hustle are long in the past. Goldman is on the attack again as it readies for a monster year."I think the world is set up at the moment to be incredibly constructive in 2026 for M&A and capital markets activity," Solomon told an analyst during the firm's fourth-quarter earnings call on Thursday. "The 2021 levels will be exceeded again. They might be exceeded in 2026."Being on the right footing is all the more important as other banks are jockeying for some of the industry's hottest deals too. In a memo to her staff on Wednesday, Citi CEO Jane Fraser warned her staff against settling for second best."The animal spirits have been unleashed," veteran Wells Fargo bank analyst Mike Mayo told Business Insider last week, noting competition among the banks is now "at its most intense level since before the global financial crisis."Here's how Goldman got its swagger back and what's still at stake.Inside the strategyMuch of Solomon's vision that's playing out today dates back to a 2020 investor day just a few weeks before the coronavirus pandemic sent the world into a tailspin. At the presentation — which featured a number of then-Goldman officials who are no longer at the bank — its leaders teased two pursuits that would go on to shape its future: "digitization" and "consumerization."Not everything went according to plan.Its consumer banking venture, Marcus, proved a costly distraction that fomented schisms among power brokers and sent some partners to the exits. Stephanie Cohen, the bank's former chief strategy officer and an architect of its consumer strategy, left the firm in 2024 to go to the tech sector.The bank retreated from many of its consumer ambitions due to ballooning spending, but the Marcus brand lives on as a deposits platform within its combined asset and wealth management business. Marcus holds more than $100 billion in consumer deposits in the US and UK, contributing to more than $500 billion in deposits overall, the bank has said.The bank also got closure on another Marcus venture this week. It has relinquished its Apple Card partnership to JPMorgan. A silver lining for the bank is that this transfer meant analysts didn't pepper Solomon with questions about President Donald Trump's 10% credit card interest proposal. Other CEOs had to address it point-blank during their earnings calls.Aside from the consumer flop, other initiatives stuck. Solomon merged the asset and wealth businesses in late 2022. The gambit appears to have paid off — the business' assets under supervision climbed nearly half a trillion dollars to $3.6 trillion last year, an all-time high, alongside investments in private banking, alternatives, and wealth management in the high-net-worth category.About a year ago, Goldman formalized its Capital Solutions Group, coalescing its advisory, financing, structuring, and risk-management capabilities. The unit's primary objective…

"Ça ne doit pas être facile tous les jours" : Claude François Jr évoque sa relation avec sa demi-soeur longtemps cachée par leur père

Au cours d'un entretien paru ce vendredi 16 janvier 2026, Claude François Jr. s'est confié sur ses relations avec les membres de sa fratrie, son frère Marc mais aussi Julie Bocquet, leur demi-sœur longtemps cachée et âgée aujourd'hui de 49 ans.

Open d'Australie : Quel parcours pour le très motivé Carlos Alcaraz à Melbourne ? #AusOpen #AO2026 #Alcaraz #CarlosAlcaraz

Le tirage au sort de lrsquo;Open drsquo;Australie 2026 a offert agrave; Carlos Alcaraz [1] un deacute;but de tournoi theacute;oriquement accessible, m ... lire la suite

Un petit espace à l’atmosphère feutrée, façon club, dans le Marais

Pathé Cinémas réorganise son équipe programmation

Pathé Cinémas réorganise son équipe programmation