Le Journal

Indiana completes undefeated season and wins first national title, beating Miami 27-21 in CFP final

Formula dispute?

His son suffers from a rare neurological genetic disorder and now the teen depends on his father for all of his basic needs, including his...

1 hospitalized with burns following house fire in NW Miami-Dade; cause is under investigation

CFP Foundation, AT&T partner to distribute laptops to high school students in Miami

Will Smith scores as the Sharks spoil Matthew Tkachuk’s return by beating the Panthers 4-1

SUNRISE, Fla. (AP) — Will Smith scored in his second consecutive game after missing a month because of injury, and the San Jose Sharks spoiled Matthew...

Intercontinental Miami debuts new concert series featuring local country singer

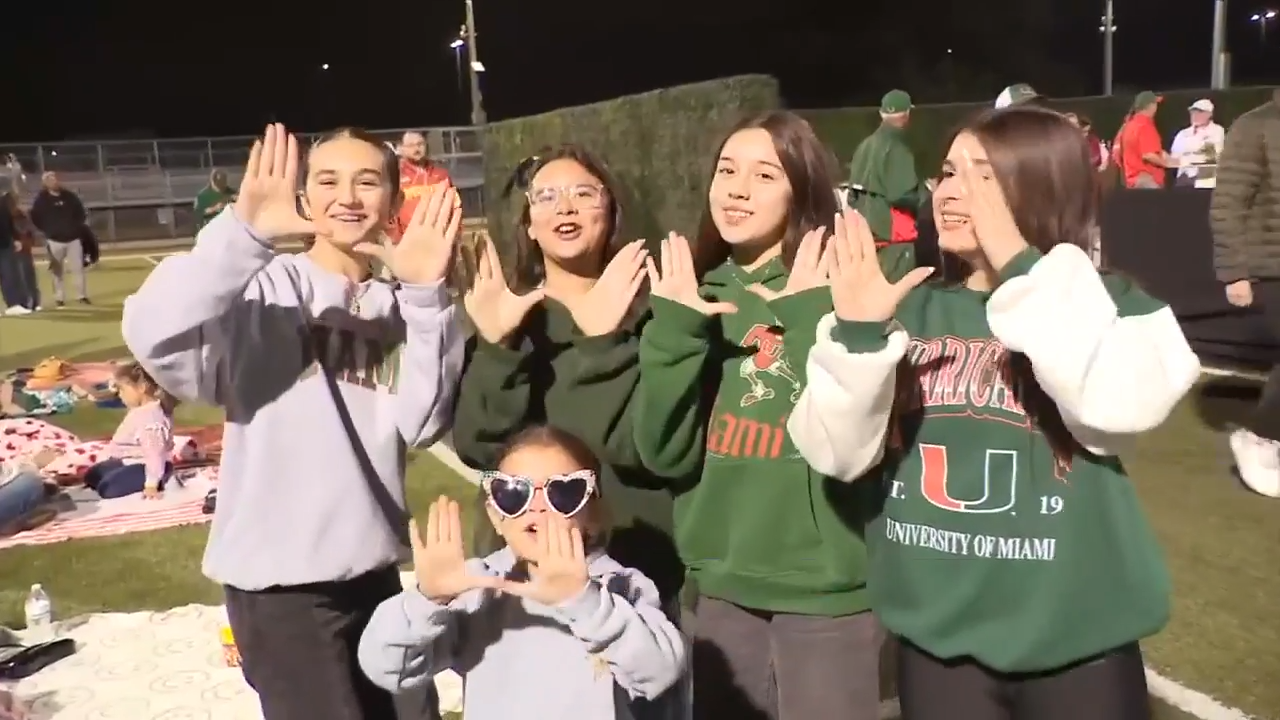

Students, fans pack Christopher Columbus High for Miami, Hoosiers championship showdown

Canes watch party draws fans to Watsco Center in Coral Gables for championship game

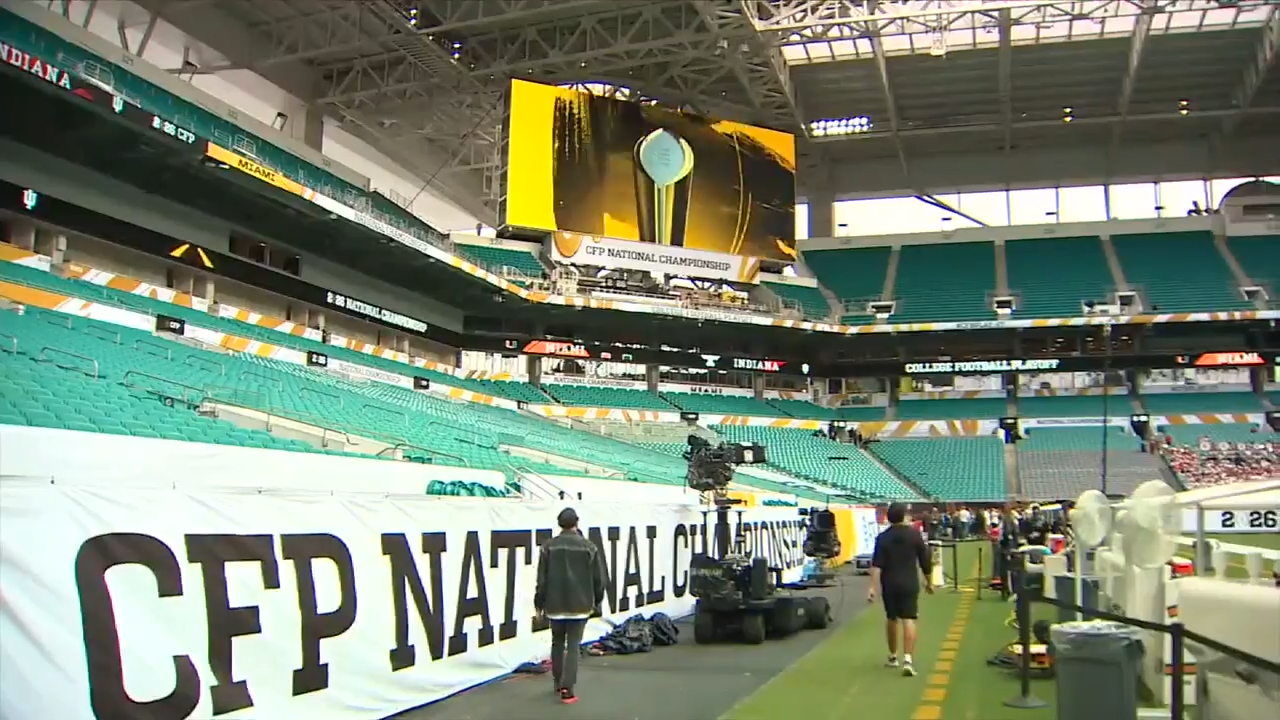

Officials put on finishing touches to field at Hard Rock Stadium as fans count down final minutes to CFP championship game

With thousands of fans partying as they wait for doors to open at Hard Rock Stadium, officials inside are hard at work making sure the...

NYC Mayor Mamdani Under Fire Not For Snubbing Black Appointees

NYC Mayor Mamdani Under Fire Not For Snubbing Black Appointees Authored by Luis Cornelio via Headline USA, Zohran Mamdani, New York City’s newly sworn-in mayor, is already facing criticism less than a month into his tenure. Not for his democratic socialist agenda, but for failing to appoint black and Hispanic officials. In New York City, the mayor relies heavily on deputy mayors, a group that functions much like a cabinet. Mamdani’s predecessor, Eric Adams, filled his administration with black and Hispanic officials, a stark contrast to Mamdani’s approach. According to a New York Times report on Thursday, some black and Latino leaders “worry they are being denied access to power under Mayor Zohran Mamdani and that they may lose the ground they had gained under former Mayor Eric Adams.” So far, Mamdani has appointed five deputy mayors. None are black, and only one is Hispanic. The imbalance has drawn backlash. “He already doesn’t have the best relationship with the Black community,” said political consultant Tyquana Henderson-Rivers. “And it seems like he’s not interested in us because there’s no representation in his kitchen cabinet.” It must be so exhausting being a lib. https://t.co/xiZtutq8A5 — Tim Carney (@TPCarney) January 16, 2026 Arc of Justice President Kristen John Foy echoed that concern, warning that Mamdani’s staffing decisions undercut his pledge of diversity. “For someone who prides himself on being directly engaged with everyday New Yorkers, to be so tone deaf to the cries of Black and Latinos in the city for access to power is shocking,” Foy said. She added, “There are some very good people of color that have been appointed to some high-level positions, but those people are not at the center of the decision-making apparatus in this city.” In response, Mamdani spokesperson Dora Pekec dismissed the criticism, claiming that 18 of the administration’s 32 appointees are minorities. Mamdani was sworn into office on Jan. 1 after campaigning as a democratic socialist and vowing to enact some of the most radical left-wing policies in New York City history. Tyler Durden Mon, 01/19/2026 - 15:30

Gold And Silver Explosion: Something Big Is Happening

Gold And Silver Explosion: Something Big Is Happening Gold and silver prices, according to Brandon Smith of Alt-Market.com, are signaling stress under the surface of the economy. From shrinking physical inventories to record central bank buying, precious metals warn that the underlying issues aren’t resolved… In early 2020 at the beginning of the pandemic hysteria I noted that the covid panic seemed to perfectly coincide with the Federal Reserve’s acceleration of interest rates and asset dumping. This trend, I argued, was a precursor to a Catch-22 scenario I have been warning about for some time. Since the crash of 2008, the central bank has used stimulus measures and near-zero interest rates to protect “too big to fail” corporations while keeping debt afloat globally. Doing this required the digital printing of tens of trillions of fiat dollars and, inevitably, a sharp devaluation in the greenback. I predicted that this would lead to stagflationary conditions (which finally hit in 2022), and the conundrum of inflation vs. deflation. The Federal Reserve could continue to keep rates low and ignore inflationary pressures to avoid a collapse of debt. Or, they could significantly raise interest rates, let the debt system take its medicine and tumble in price and squelch the effects of inflation by suppressing consumer demand. Either choice could cause an economic crisis. Maybe it’s understandable that the Fed decided not to choose. Instead, they raised rates but not enough to reverse stagflation. They took the middle road and refused to allow the economy to take its much-needed medicine, postponing a reckoning for badly-priced malinvestments. Essentially, kicking the can down the road for the next administration to deal with. Consequences of the Fed’s too-little-too-late strategy This means we are still stuck with the massive price increases we incurred during the Biden Administration. Granted, the rate of inflation has slowed. But the cost of living is significantly higher than just five years ago. (Remember, above-zero inflation doesn’t mean prices fall – it means they keep rising, but more slowly.) In 2020 I wrote an article titled Physical Gold Will Soon Break Free from the Paper Market in Spectacular Fashion, predicting skyrocketing precious metals values once this Catch-22 situation became apparent to investors. I predicted that buyers would increasingly drop financial derivatives (futures etc.) in favor of physical delivery of gold and silver, causing physical prices to go parabolic. This is now happening. Since I wrote that article, the price of gold per ounce jumped over 200%. Silver prices have exploded by 400%. Global inventories of physical metals have plunged London vaults are reportedly down 30% since 2022 Refiners report 10-14 week delays for new bullion bars (vs. normal 2-4 weeks) Physical redemptions of commodities contracts have accelerated to historically unprecedented levels Via Clive Thompson on LinkedIn. Thompson adds: “This marks a dramatic behavioral shift: historically less than 1% of COMEX contracts resulted in physical delivery, but in 2025, some months delivery notices reached 100%.” Silver is sitting at an all time high of $90 an ounce as I write this. Gold is closing in on $4700 per ounce. (Maybe large banks like JP Morgan are deliberately backing away from market manipulation for some reason?) Global central bank gold buying has reached historic levels every year since 2022, surpassing even the levels we saw in the wake of the Great Financial Crisis. All that is background – what does it mean? The economic singularity It seems to me that we are witnessing an economic singularity – a moment of great change. Or, at the very least, the warning signs of an imminent change. Precious metals prices are trying to tell us something. The problem is, that message is mostly being ignored, even by more conservative platforms. Not enough people are talking about what’s happening with precious metals and what it…