Le Journal

"C’est un bouleversement" : Juan Arbelaez fait des confidences sur sa compagne Cassandre Verdier et leur futur bébé

Sarah (Star Academy) se confie sur sa rupture avec une personne qui avait "dix ans de plus" qu'elle : "J'ai dû prendre une décision"

Dans le live de la Star Academy du mercredi 21 janvier, Sarah s'est confiée sur une relation amoureuse à laquelle elle a mis un terme avant d'entrer au château. Une décision difficile pour la candidate.

Steal (Prime Video) : il faut avoir les nerfs bien accrochés pour survivre au premier épisode

Pas de millionnaire au tirage du Swiss Loto

Osiris : C'est quoi ce film de science-fiction jamais sorti au cinéma qui cartonne en France ?

Depuis quelques jours, le film de science-fiction Osiris cartonne sur Prime Video en France. Celui-ci n’a jamais eu droit à une sortie au cinéma, mais il est désormais 4e du top.

Watch Live: President Trump's (Delayed) Interview With CNBC's Joe Kernen

Bessent Says Deutsche Bank CEO Called To Dismiss Research Note On US Assets

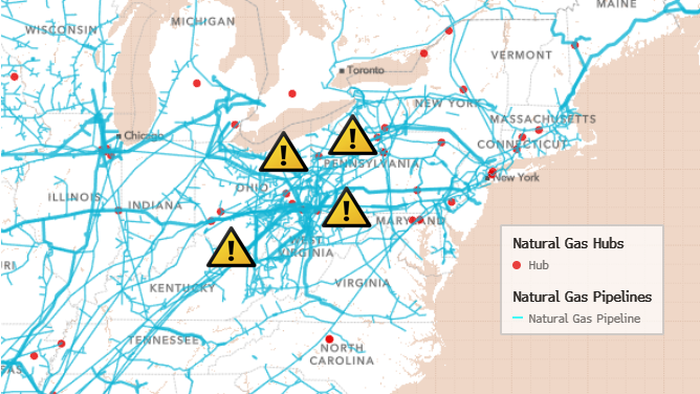

Appalachian NatGas Output Faces "Intense Losses" As Arctic Blast Drives Power Grid Risk Higher

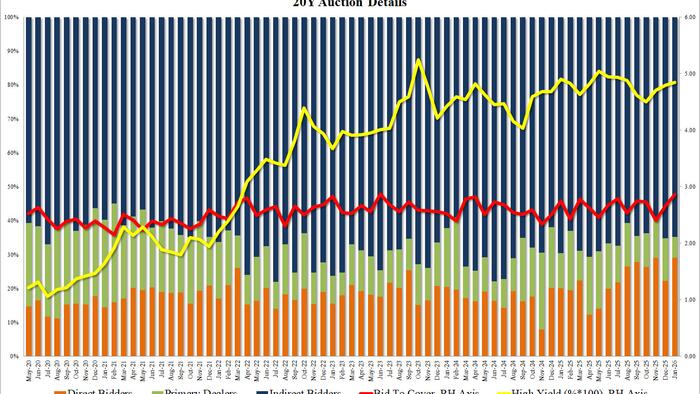

Stellar 20Y Auction Stops Through With Near Record Bid To Cover, Record Directs

Stellar 20Y Auction Stops Through With Near Record Bid To Cover, Record Directs In a week when global yields have exploded higher following the historic rout in Japan's bond market, many were nervous about the outcome of today's 20Y Treasury auction. In retrospect, they had no reason to be worried: the auction closed with flying colors amid solid demand. The high yield of today's sale of $13BN in 20Y paper was 4.846%, up from 4.798% a month ago and the highest since August; it also stopped through the When Issued 4.856% by 1bps , the biggest stop through since October, and also the 6th stop in the past 7 auctions. More impressive still, the bid to cover was 2.86, up from 2.67 in December and the second highest on record (only June 2023 was higher). The internals were a touch softer with Indirects awarded 64.72%, down from 65.19%, but above the six auction average of 63.5%. And with Directs taking 29.1%, tied for the highest on record, Dealers were left with just 6.2%, one of the six year history of the auction. Overall, this was a stellar 20Y auction, and one which pushed yields in the secondary market slightly lower after news of the break, although with many other factors determining yields (Japan, Greenland, earnings), don't expect the auction's impact on the broader market to last. Tyler Durden Wed, 01/21/2026 - 13:29

OM-Liverpool : Ambiance grandiose à deux heures du match

L’OM affronte Liverpool au Vélodrome ce mercredi soir lors de la 7e journée de Ligue des Champions et les supporters phocéens font déjà monter la température à l’extérieur du stade. A deux heures du coup d’envoi, les fans de l’Olympique de Marseille se sont déjà rassemblés par milliers aux alentour...

The Stock Market Isn't A Market Anymore - It's A Political Control Mechanism

The Stock Market Isn't A Market Anymore - It's A Political Control Mechanism Authored by Nick Giambruno via InternationalMan.com, It has become increasingly clear to me that the stock market is no longer a stock market in the traditional sense. Its primary purpose was once straightforward: a venue where companies could raise capital by selling shares to the public, and where investors could freely buy and sell those shares among themselves. Today, the market still performs that function — but it has been far overshadowed by three larger, unofficial roles that have become existential to social and political stability: Liquidity Sponge: All the trillions in newly created currency units have to go somewhere. Better to have them chasing stocks than bidding up the price of groceries. De Facto Savings Account: Most people treat their brokerage account as if it were a savings account. Their financial futures depend on the stock market continuing to rise. But putting money into the stock market is not saving — it’s investing, and that’s a very different thing. The rapid debasement of fiat currency has destroyed savings for the average person, forcing them into riskier assets like stocks in a desperate attempt to outpace inflation. Crucial Tax Revenue: Taxes on capital gains, dividends, corporate profits, and other market-related activity have become an essential pillar of government funding. As the failure of DOGE — the most serious attempt to cut federal spending in most people’s lifetimes — demonstrated, it’s politically impossible to even slow the growth rate of federal spending, let alone cut it. It doesn’t matter which party is in office; they’re all headed in the same direction. It’s like riding a runaway train with no brakes. Issuing debt and then printing money to buy that debt remains one of the primary ways this out-of-control spending is financed. All those new currency units need an outlet. If people lose interest in the stock market because it has declined, those freshly created dollars will start flowing elsewhere, bidding up the prices of housing, food, and other basic necessities, which could trigger real social upheaval. Another reason the government cannot allow the stock market to fall is that it would devastate retirement savings and infuriate the most politically active demographic. It’s a near-guaranteed way to lose the next election. A third reason is fiscal. A declining market would slash hundreds of billions in federal revenue from taxes on capital gains, dividends, corporate profits, and other market-linked activity. That shortfall would further explode the deficit, which would then need to be financed by even more borrowing and even more money printing, compounding the problem. This is why, in short, the political establishment cannot tolerate a sustained downturn in the stock market. It would unleash intense social and political instability that could bring down the entire system. And this is also why the stock market is no longer primarily a stock market in the traditional sense. It has become a mechanism that the political establishment relies on to maintain control. This is the backdrop behind today’s absurd valuation metrics. The S&P 500’s Price-to-Earnings (P/E) and CAPE (Cyclically Adjusted P/E) ratios are near historical highs, while Free Cash Flow Yield and Dividend Yield are near historical lows. Meanwhile, Market Cap to GDP (the Buffett Indicator) sits at a record high. It measures the total value of the US stock market relative to US GDP. Today, that ratio stands at roughly 221% — far exceeding prior peaks of 139% at the height of the dot-com bubble in 2000 and 106% at the peak of the housing bubble in 2007. These are just a few examples. Nearly every fundamental measure of valuation is at or near all-time highs — and still climbing. This highlights the biggest challenge with investing today: rampant money printing by central banks has distorted financial markets like never before, rendering…