Le Journal

"C’est un bouleversement" : Juan Arbelaez fait des confidences sur sa compagne Cassandre Verdier et leur futur bébé

Sarah (Star Academy) se confie sur sa rupture avec une personne qui avait "dix ans de plus" qu'elle : "J'ai dû prendre une décision"

Steal (Prime Video) : il faut avoir les nerfs bien accrochés pour survivre au premier épisode

Si vous n’avez pas peur de mettre vos nerfs à rude épreuve, alors profitez du week-end qui arrive pour découvrir Steal, le nouveau thriller avec Sophie Turner, mis en ligne ce mercredi 21 janvier sur Prime Video.

Pas de millionnaire au tirage du Swiss Loto

Watch Live: President Trump's (Delayed) Interview With CNBC's Joe Kernen

Bessent Says Deutsche Bank CEO Called To Dismiss Research Note On US Assets

Bessent Says Deutsche Bank CEO Called To Dismiss Research Note On US Assets US Treasury Secretary Scott Bessent, speaking at the World Economic Forum earlier today, said Deutsche Bank AG CEO Christian Sewing called him to disavow an analyst report from the bank that warned European investors could sell US assets amid the latest President Donald Trump-EU dispute over Greenland. "We saw a six standard deviation move in Japanese bonds, which has spilled over to other markets, and I've been in touch with my Japanese economic colleagues, and I'm assured that they will take measures to stabilize that market and just so everyone knows that this notion that Europeans would be selling US assets came from a single analyst at Deutsche Bank. Of course, the fake news media led by the Financial Times amplified it, and the CEO of Deutsche Bank called to say that Deutsche Bank does not stand by that analyst report," Bessent told reporters at Davos. The research note in question comes from DB's chief forex strategist, George Saravelos, who told clients on Sunday that Europe held approximately $8 trillion of US equities and bonds, making it America's largest creditor and underlining Washington's reliance on foreign capital to finance deficits. "We spent most of last year arguing that for all its military and economic strength, the US has one key weakness: it relies on others to pay its bills via large external deficits. Europe, on the other hand, is America's largest lender," Saravelos wrote. Saravelos did not predict a sell-off but warned that rising geopolitical tensions could force some European investors to rebalance away from the dollar, citing past repatriation by the Danish pension fund. Headline yesterday... *DANISH PENSION FUND AKADEMIKERPENSION TO EXIT US TREASURIES — zerohedge (@zerohedge) January 20, 2026 "In an environment where the geoeconomic stability of the Western alliance is being disrupted existentially, it is not clear why Europeans would be as willing to play this part . . . With [US dollar] exposure still very elevated across Europe, developments over the last few days have the potential to further encourage dollar rebalancing," he said. We cited Bloomberg macro strategist Simon White, who noted earlier: "Any potential threat by Europe to sell its Treasuries in retaliation for President Donald Trump's aim to annex Greenland is likely to be empty." Read White's note here. Tyler Durden Wed, 01/21/2026 - 13:50

OL : 90 ME à rembourser, Textor risque gros

Accusé de ne pas avoir tenu ses engagements pris au moment du rachat de l’Olympique Lyonnais, John Textor risque d’être condamné à rembourser 90 millions d’euros à l’actionnaire minoritaire Iconic. L’Américain n’a pas obtenu gain de cause suite à son appel. La situation de John Textor ne s’améliore...

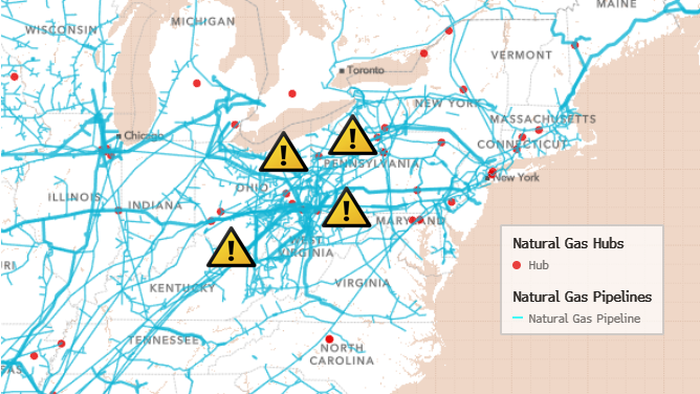

Appalachian NatGas Output Faces "Intense Losses" As Arctic Blast Drives Power Grid Risk Higher

Appalachian NatGas Output Faces "Intense Losses" As Arctic Blast Drives Power Grid Risk Higher The Lower 48 has entered the depths of Northern Hemisphere winter. A series of Arctic cold blasts, combined with fears of a 1996-style blizzard stretching from Texas through the Mid-Atlantic and into the Northeast, has sent U.S. natural gas futures quite literally vertical, marking the largest weekly spike on record (that's if gains hold through Friday). But the next focus now turns to Appalachian Basin gas production, which sits at the center of severe winter reliability risk just as demand surges across the eastern half of the country. January 20-21, 1985 low temperatures across Lower 48. 4.1°F average low temperature on the 21st. That's it. We'll be looking at about 10°F this Sat/Sun. pic.twitter.com/4x5Jer4dX4 — Ryan Maue (@RyanMaue) January 21, 2026 Criterion Research's James Bevan, vice president of research, has drawn our attention to freeze-off risks across the critical gas production hubs in the Appalachian region. This area is driven by the Marcellus Shale and Utica Shale, which produce roughly one-third of total U.S. NatGas. Bevan explains: The Appalachian production basin is poised for intense losses with the incoming winter storm. As volumes stand today at 35.5 Bcf/d, they have regained some of the last few days of freeze off losses but they are far shy of recent highs closer to 37 Bcf/d. We should see some more upwards movement in the next 2–3 days before the next round of cold hammers the region. Freeze offs are going to happen again by the weekend. It's just a matter of how much and how long those impact supply. Winter Storm Elliott in December 2022 pushed Pittburgh to overnight lows of -3.7F at the peak cold that weekend, and production was crushed as a result. Winter Storm Elliott in December 2022 had a massive impact on regional production. As regional temps fell into the single digits, observed production nominations declined 26% at their lowest to a minimal 25.2 Bcf/d. We overlaid the Pittsburgh, PA low temperatures during Winter Storm Elliott (2022) with the coming cold shot, and the 1/30 cold event has similar overnight lows on 1/23-1/24. However, the cold lingers long after that versus the rapid warming seen during Elliot that propelled averages back into the 40-50F range within a week. Appalachian gas production is going to fall substantially over the weekend, and that could push it to 30 Bcf/d or lower depending on what infrastructure is impacted during the event. The screenshot from our Mapping Analytics Platform below shows all production meters in the region (green dots) and processing plants (pink dots) — and the key item to watch is where winter precipitation hits and where the power outages hit. Those two factors will drive how bad production losses end up The MAP Analytics tool also lets you dig into specific states and pipelines, isolate what their production receipts looked like during specific events and times like Winter Storm Elliott or other deep freezes. Review note from earlier: US NatGas Poised For Biggest Weekly Spike On Record As "Blizzard Of '96" Fears Resurface Our risk assessment suggests that the combination of dangerously cold air and a major winter storm could cascade into a severe power grid risk. Freeze-offs and power outages across the Appalachian region could materially disrupt NatGas flows to power plants at the exact moment demand is peaking. Recall Winter Storm Uri in 2021, when extreme cold paralyzed the NatGas supply and collapsed the ERCOT grid in Texas for a week. A scenario like that could be in play in parts of the eastern US, regions where power grids are already tight because of bad 'green' energy policies colliding with the era of data centers. Tyler Durden Wed, 01/21/2026 - 13:35

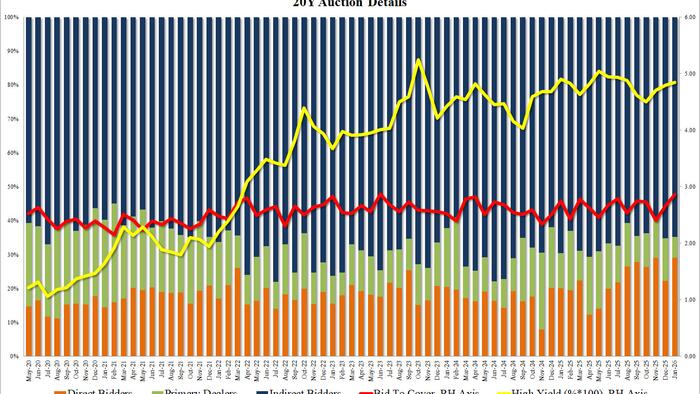

Stellar 20Y Auction Stops Through With Near Record Bid To Cover, Record Directs

OM-Liverpool : Ambiance grandiose à deux heures du match