Le Journal

Indiana completes undefeated season and wins first national title, beating Miami 27-21 in CFP final

Formula dispute?

His son suffers from a rare neurological genetic disorder and now the teen depends on his father for all of his basic needs, including his...

1 hospitalized with burns following house fire in NW Miami-Dade; cause is under investigation

CFP Foundation, AT&T partner to distribute laptops to high school students in Miami

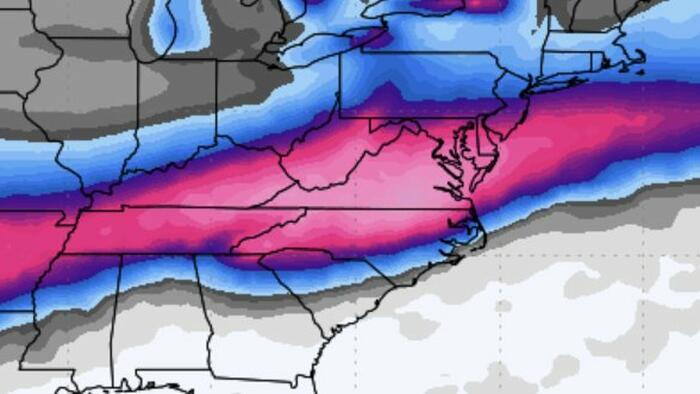

This Could Be The Big One

This Could Be The Big One Authored by weather observer Ryan Hall, There are winter storms, and then there are storms that come from a real pattern shift. The kind that don't just brush one region, but impact a big chunk of the country. This upcoming setup is starting to look like the second type. Over the last day or so, confidence has increased that we're heading into a legitimate winter storm window late this week into the weekend. The signal is becoming clearer across guidance, and the ingredients are lining up in a way that usually gets my attention. The Big Picture A strong Arctic high is pushing into the central and eastern United States. This isn't a quick shot of cold air. It's a deep, dense cold dome that sets up first and stays in place. At the same time, a southern stream trough is expected to eject out of the Southwest. That system will pull moisture northward over the top of the cold air already in place at the surface. That overrunning setup is one of the more efficient ways to produce widespread snow, sleet, and freezing rain across the South and East. About the Analogs You may see comparisons to past storms like January 1988 or February 2010 being mentioned. It's important to be careful with that. No two storms are exactly alike, and analogs aren't about matching totals or impacts. Where they can be useful is in highlighting similar large-scale processes. In this case, things like a strong southwestern trough, deep cold air already in place, and a steady moisture feed overrunning the cold dome. In some respects, this setup has more cold air to work with and a broader moisture source than those events did at similar lead times. That's why it stands out. Days 4-5: Friday Focus By Friday, attention shifts to the Southern Plains and the Lower Mississippi Valley. Snow and mixed precipitation look increasingly likely from the Texas Panhandle through Oklahoma, Arkansas, and into parts of the Tennessee Valley. This part of the storm will likely feature a sharp gradient between snow, sleet, and freezing rain, especially near the southern edge of the cold air. Small shifts in track or temperature profiles could have large impacts in this region. Days 6-7: Weekend Evolution As we head into Saturday and Sunday, the system is expected to move east across the Southeast, with the potential to turn northeast near the coast. Cold air is already established well north of the system, which raises confidence that much of the precipitation will fall as wintry weather. The biggest question now is how far north the heavier precipitation shield extends and how much phasing occurs between northern and southern stream energy. That will determine whether the highest impacts remain focused on the Mid-Atlantic or expand farther north. What I'm Watching Strength and placement of the Arctic high Timing and amplitude of the southern stream trough How quickly the streams interact Placement of the rain-snow line Icing potential along the southern edge These details should come into better focus over the next few days. Bottom Line This is shaping up to be a potentially high-impact winter storm affecting a large portion of the Southern and Eastern U.S. It's still too early to lock in exact totals or specific cities. But it's early enough to say this is a system worth taking seriously. If you live from the Southern Plains through the Tennessee Valley and into the Mid-Atlantic, this is one you should be planning around, not ignoring. We'll keep refining the details as the data comes in. If the signal weakens, we'll say that. But right now, this setup has the look of a storm that could end up being memorable. Tyler Durden Mon, 01/19/2026 - 18:00

Newsom Strains To Flip Script On California's Failures

Kansas School Bans Students From Naming Kirk, Trump Or Jesus As Role Models

US Lender Newrez To Accept Crypto Holdings In Mortgage Approval

Minneapolis Police Face Mass Exodus As New Paid Leave Program Hits Amid Riots

Minneapolis Police Face Mass Exodus As New Paid Leave Program Hits Amid Riots Minneapolis faces a compounding crisis, as dozens of police officers are expected to tap into a new state paid leave program while the city grapples with anti-ICE riots and a staffing shortage that has stretched the department to its breaking point. Between 60 and 100 officers from the Minneapolis Police Department have applied for or plan to apply for the Paid Family and Medical Leave (PFML) program, which took effect on January 1, according to multiple sources who spoke with Alpha News senior reporter Liz Collin and Crime Watch Minneapolis. The timing could hardly be worse for a city already reeling from violent protests following the shooting death of Renee Good, who was killed by an ICE agent after she attempted to run over a federal officer with her vehicle. The PFML program was signed into law by Gov. Tim Walz in 2023, which he promoted as a way to give workers time off for family or medical reasons, including up to 20 weeks of paid leave funded with public money. Many had lined up to use the 20-week paid leave window as soon as it opened on January 1. “The PFML program allows workers to take up to 12 weeks of medical leave or family leave per year. If someone decides to use a combination of family and medical leave, they can receive benefits for up to 20 weeks,” explains Alpha News. “During that leave, program recipients are paid between 55% and 90% of their regular wages. At present, weekly benefits cannot exceed $1,423 per week. The funding for the program comes from payroll taxes on employers and employees.” The program also explicitly allows illegal immigrants to access the benefits that police officers use. The news of MPD officers applying for the program also comes following the acknowledgement in an email last week to officers from the Police Officers Federation of Minneapolis that MPD morale is at an all-time low. The email detailed the “dangerously low” staffing levels causing stress and burnout, as well as political rhetoric and “inflammatory statements” from elected officials, which is emboldening hostility toward officers. The department is already struggling daily to fill shifts, as was revealed this week in copies of emails obtained by Crime Watch showing shift sergeants desperately asking for officers to sign up for overtime to fill shifts. Applications for the program surged quickly, with about 18,000 filed in the first week of the month and roughly 25,000 by last Monday. Initial projections estimated around 130,000 participants over the entire first year. Minneapolis declined to respond directly to Alpha News. Still, it acknowledged on social media that employees, including MPD officers, have requested leave, claiming most applicants were already on leave at the end of 2025 for reasons such as pregnancy, newborn bonding, or caring for a family member, while declining to dispute the reported number of officers involved. A big problem with the program Walz created is that the statute sets no limit on how many employees from a single department, office, or employer can take leave at the same time, leaving entire units vulnerable to being depleted all at once with no built-in safeguard. Alpha News reports that officers planning to use PFML are required to give 30 days’ notice before going on leave, yet the clustering of applications from Minneapolis police as the program goes live raises serious questions about the timing. The department is now operating with roughly 600 officers, down about 300 from nearly 900 before the pandemic lockdowns and the death of George Floyd. Many officers retired or left the force after that disaster. This time, officers have effectively checked out by applying for paid leave under Walz’s program rather than resigning outright. Between ongoing rioting, chronic understaffing, and a paid leave program with no guardrails against mass absences, Minneapolis is facing a perfect storm, and its political…

NYC Mayor Mamdani Under Fire Not For Snubbing Black Appointees

NYC Mayor Mamdani Under Fire Not For Snubbing Black Appointees Authored by Luis Cornelio via Headline USA, Zohran Mamdani, New York City’s newly sworn-in mayor, is already facing criticism less than a month into his tenure. Not for his democratic socialist agenda, but for failing to appoint black and Hispanic officials. In New York City, the mayor relies heavily on deputy mayors, a group that functions much like a cabinet. Mamdani’s predecessor, Eric Adams, filled his administration with black and Hispanic officials, a stark contrast to Mamdani’s approach. According to a New York Times report on Thursday, some black and Latino leaders “worry they are being denied access to power under Mayor Zohran Mamdani and that they may lose the ground they had gained under former Mayor Eric Adams.” So far, Mamdani has appointed five deputy mayors. None are black, and only one is Hispanic. The imbalance has drawn backlash. “He already doesn’t have the best relationship with the Black community,” said political consultant Tyquana Henderson-Rivers. “And it seems like he’s not interested in us because there’s no representation in his kitchen cabinet.” It must be so exhausting being a lib. https://t.co/xiZtutq8A5 — Tim Carney (@TPCarney) January 16, 2026 Arc of Justice President Kristen John Foy echoed that concern, warning that Mamdani’s staffing decisions undercut his pledge of diversity. “For someone who prides himself on being directly engaged with everyday New Yorkers, to be so tone deaf to the cries of Black and Latinos in the city for access to power is shocking,” Foy said. She added, “There are some very good people of color that have been appointed to some high-level positions, but those people are not at the center of the decision-making apparatus in this city.” In response, Mamdani spokesperson Dora Pekec dismissed the criticism, claiming that 18 of the administration’s 32 appointees are minorities. Mamdani was sworn into office on Jan. 1 after campaigning as a democratic socialist and vowing to enact some of the most radical left-wing policies in New York City history. Tyler Durden Mon, 01/19/2026 - 15:30

Gold And Silver Explosion: Something Big Is Happening

Gold And Silver Explosion: Something Big Is Happening Gold and silver prices, according to Brandon Smith of Alt-Market.com, are signaling stress under the surface of the economy. From shrinking physical inventories to record central bank buying, precious metals warn that the underlying issues aren’t resolved… In early 2020 at the beginning of the pandemic hysteria I noted that the covid panic seemed to perfectly coincide with the Federal Reserve’s acceleration of interest rates and asset dumping. This trend, I argued, was a precursor to a Catch-22 scenario I have been warning about for some time. Since the crash of 2008, the central bank has used stimulus measures and near-zero interest rates to protect “too big to fail” corporations while keeping debt afloat globally. Doing this required the digital printing of tens of trillions of fiat dollars and, inevitably, a sharp devaluation in the greenback. I predicted that this would lead to stagflationary conditions (which finally hit in 2022), and the conundrum of inflation vs. deflation. The Federal Reserve could continue to keep rates low and ignore inflationary pressures to avoid a collapse of debt. Or, they could significantly raise interest rates, let the debt system take its medicine and tumble in price and squelch the effects of inflation by suppressing consumer demand. Either choice could cause an economic crisis. Maybe it’s understandable that the Fed decided not to choose. Instead, they raised rates but not enough to reverse stagflation. They took the middle road and refused to allow the economy to take its much-needed medicine, postponing a reckoning for badly-priced malinvestments. Essentially, kicking the can down the road for the next administration to deal with. Consequences of the Fed’s too-little-too-late strategy This means we are still stuck with the massive price increases we incurred during the Biden Administration. Granted, the rate of inflation has slowed. But the cost of living is significantly higher than just five years ago. (Remember, above-zero inflation doesn’t mean prices fall – it means they keep rising, but more slowly.) In 2020 I wrote an article titled Physical Gold Will Soon Break Free from the Paper Market in Spectacular Fashion, predicting skyrocketing precious metals values once this Catch-22 situation became apparent to investors. I predicted that buyers would increasingly drop financial derivatives (futures etc.) in favor of physical delivery of gold and silver, causing physical prices to go parabolic. This is now happening. Since I wrote that article, the price of gold per ounce jumped over 200%. Silver prices have exploded by 400%. Global inventories of physical metals have plunged London vaults are reportedly down 30% since 2022 Refiners report 10-14 week delays for new bullion bars (vs. normal 2-4 weeks) Physical redemptions of commodities contracts have accelerated to historically unprecedented levels Via Clive Thompson on LinkedIn. Thompson adds: “This marks a dramatic behavioral shift: historically less than 1% of COMEX contracts resulted in physical delivery, but in 2025, some months delivery notices reached 100%.” Silver is sitting at an all time high of $90 an ounce as I write this. Gold is closing in on $4700 per ounce. (Maybe large banks like JP Morgan are deliberately backing away from market manipulation for some reason?) Global central bank gold buying has reached historic levels every year since 2022, surpassing even the levels we saw in the wake of the Great Financial Crisis. All that is background – what does it mean? The economic singularity It seems to me that we are witnessing an economic singularity – a moment of great change. Or, at the very least, the warning signs of an imminent change. Precious metals prices are trying to tell us something. The problem is, that message is mostly being ignored, even by more conservative platforms. Not enough people are talking about what’s happening with precious metals and what it…