Le Journal

Troops stand by to enter Minnesota. And, Trump plans for a Board of Peace

PCR: The EU Elite Have Banned European Democracy

PCR: The EU Elite Have Banned European Democracy Authored by Paul Craig Roberts, In a democracy, the government in office cannot ban an opposing candidate from running on the grounds that the candidate would win and take the place of the current government. But that is what President Macron has done to Marine Le Pen. Le Pen heads the largest political party in France. She has been banned by a French court from holding office for five years. This prevents her from competing in the 2027 presidential election, where she has long been considered to be the leading candidate. The excuse used by the French government to frustrate the popular will is that Le Pen was convicted of “misappropriating EU funds.” She was convicted of using money intended for her European Union staff for her French staff. Money, of course, is fungible, and the orchestrated charge succeeded only because the establishment presstitutes hyped it over and over. Marine Le Pen is a controversial figure with the French establishment because she represents ethnic French nationalism, not the globalism of open borders and multiculturalism, that is, she stands for France, not for a Tower of Babel. All over Europe the left-wing ideologues have succeeded in associating ethnic nationalism with Nazism. An effort has been underway for decades to destroy the sovereignty of national states, and to merge them into the European Union. Le Pen has fought the effort to abolish France, and for her efforts she has been branded a Nazi. Despite the French establishment’s attempt to demonize her, her party has the largest public support. Over the years, the European left succeeded in branding national sovereignty “right-wing.” Even the Russian news site RT unthinkingly uses the propaganda term of the European left, thus demonstrating how unaware the Russian media is of the character of their European enemies. When Le Pen appealed the ruling at the European court of human rights the court side-stepped the issue by ruling that she had not shown an “imminent risk of irreparable harm” to herself. Of course, the harm was done to French democracy and to the French electorate, an issue that the court avoided. Clearly “European democracy” stands unified in opposing democracy and has prevented the French people from exercising their will in a presidential election by banning the opposing candidate from running for the presidency. Le Pen has again appealed and declared “I hope I will be able to convince the judges of my innocence.” But for the establishment, the question is not one of innocence or guilt. The the issue is that the European elite intend to prevent any revival of national sovereignty. The people’s will is no longer tolerated in Western Europe. Tyler Durden Mon, 01/19/2026 - 05:10

Trump's Planned Mediation Between Egypt & Ethiopia Might Worsen Regional Tensions

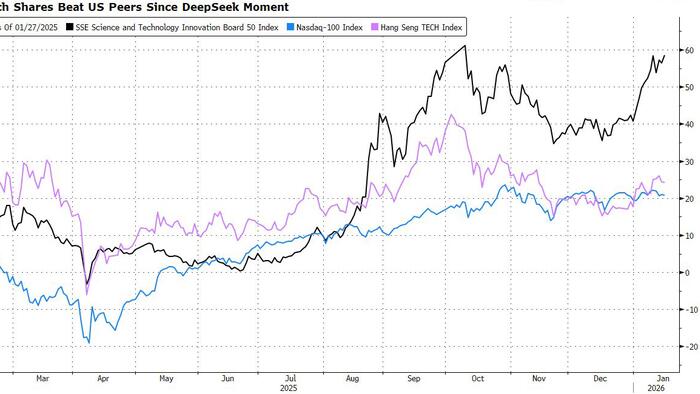

China Tech Boom Leaves Economic Malaise Behind

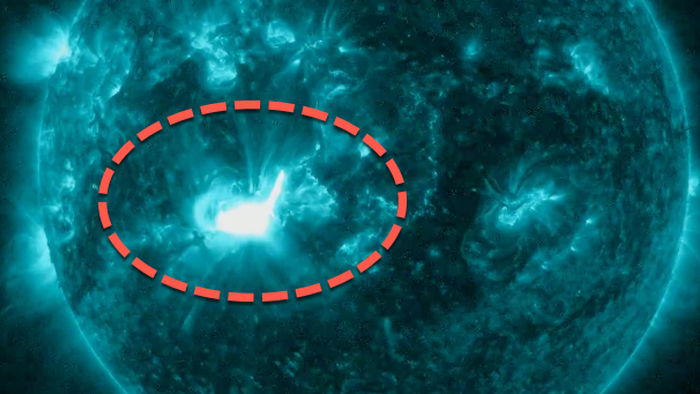

Massive High-Velocity Coronal Mass Ejection Blasts From Sun, Earth Impact Possible In Days

Massive High-Velocity Coronal Mass Ejection Blasts From Sun, Earth Impact Possible In Days The Space Weather Prediction Center issued an alert Sunday afternoon after a powerful X1.9 solar flare erupted on the Sun, with the space weather event expected to produce an Earth-directed coronal mass ejection (CME). Stefan Burns, a geophysicist and space weather forecaster, wrote on X that the X1.9 flare is "insane" and will produce a "huge coronal mass ejection." Major X1.9 solar flare detected at 18:08 UTC (Jan 18) around AR 4341. Earth directed CME likely. More to follow. https://t.co/aqK4Q6XdAY pic.twitter.com/CJUq1SAsQt — SolarHam (@SolarHam) January 18, 2026 "A huge coronal mass ejection has been launched toward Earth at high velocity. We will have a BIG solar storm impact in 2 to 3 days. Expect at least G3 geomagnetic storming. Early forecasts are liable to revision as more data comes in," Burns said. This 1.9 X-flare that just exploded on the Sun IS INSANE. A huge coronal mass ejection has been launched out towards Earth at high-velocity, we'll have a BIG solar storm impact in 2-3 days, expect G3 geomagnetic storming minimum (early forecast liable to revision with more data). pic.twitter.com/v7uDX1JdIW — Stefan Burns (@StefanBurnsGeo) January 18, 2026 Space Weather News' Ben Davidson streamed a live analysis on YouTube earlier about the X-class solar flare and what to expect... The X-class flare can disrupt radio and navigation immediately. The larger risk comes from the expected CME in the coming days, which can trigger geomagnetic storms that affect power grids, satellites, aviation, and the modern economy built on chips and data centers. Tyler Durden Sun, 01/18/2026 - 22:45

Venezuela, Silver And Greenland: How The U.S.-China Power Split Is Reshaping the World

One Chart Says Time To Reload On This Commodity

Americans Report Surging Spirituality: 43% Say Faith Has Grown Amid National Revival

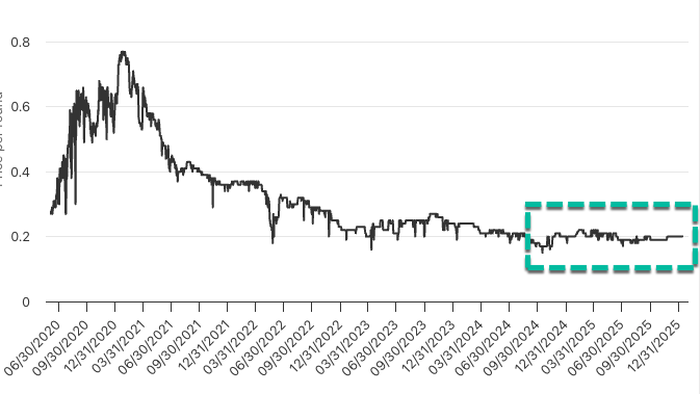

Housing Market's Deep Freeze May Finally Begin To Thaw

Housing Market's Deep Freeze May Finally Begin To Thaw Realtors, mortgage lenders, and other industry professionals: if three years of depressed transaction activity have you thinking about exiting, it may be worth holding that thought for now. A new Goldman note suggests that policy maneuvering by the Trump administration could partially unfreeze the housing market in the upcoming selling season, potentially reviving some activity. The Trump administration is attempting to unfreeze a housing market paralyzed by elevated mortgage rates and high home prices, which have pushed affordability to generational lows. Goldman analyst Arun Manohar penned a note on Wednesday asking clients: All hands on deck to fix US housing affordability? Manohar highlighted several key housing policies under the Trump administration: a recently announced $200 billion MBS purchase program aimed at lowering mortgage rates, a proposed ban on institutional investors buying single-family homes, and additional measures designed to reduce the cost of homeownership. Here's the note: Affordability, particularly in the context of housing, has recently been a central focus for the Trump administration. In a national televised address delivered in December, the President announced forthcoming plans which he described as "the most aggressive housing reform plans in American history." According to media reports, President Trump is expected to introduce several initiatives aimed at enhancing housing affordability during his upcoming speech at the World Economic Forum in Davos. To date, two policies have been previewed, each of which has already had market moving impacts. In today’s Global Markets Daily, we discuss the impact of recently introduced policies and outline additional measures that may be under consideration. GSE MBS purchase program has already pushed mortgage rates lower by 15bp On January 8th, President Trump posted on social media that he has instructed his representatives to buy $200 billion of mortgage bonds. Subsequently, Director Pulte and Secretary Bessent have essentially confirmed that the buying is being carried out by the government sponsored enterprises (GSEs) – Fannie and Freddie. Although very limited details about the program are available so far, the agency MBS market has quickly priced in the program with production coupon spreads tightening around 14-15bp so far. We believe the spread tightening so far is consistent with a program of this magnitude and hence believe that it is fully priced-in. Mortgage rates have also declined in tandem and are now close to the lowest levels since September 2022 (Exhibit 1). This should improve affordability and improve sentiment in the housing market ahead of the key spring homebuying season. We believe that the cumulative decline of around 80bp in mortgage rates since June 2025 could boost existing home sales by at least 5-7% in 2026 vs. 2025. Moreover, it is possible that the administration could push new Fed leadership to provide additional support to housing by reinvesting monthly run-offs from the Fed’s portfolio back into MBS. However, as we noted recently, if the $200 billion purchase program is a one-off, and there are no other MBS purchase programs from the GSEs/Fed/Treasury, then MBS spreads are likely to end the year wider vs. current levels. Agency MBS nominal spreads are already tighter vs. their longer-term average, and OASs are at levels last observed during the Fed’s QE purchase program (Exhibit 2). Therefore, the key risk for the housing market is that the decline in mortgage rates over the past two days reverses by the end of the year. Proposed ban on institutional investors from purchasing single family homes The other major housing policy announcement from last week was President Trump’s intention to ban institutional investors from buying single-family homes. While the goal of this policy is to reduce competition from institutions and increase supply/reduce prices for…

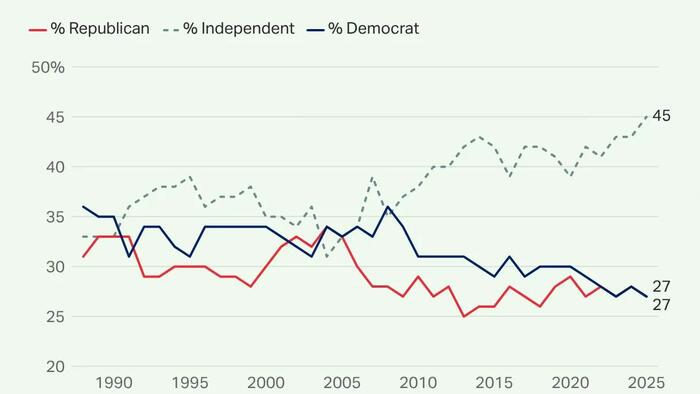

Face Reality: Two-Party Politics Has Failed!

Face Reality: Two-Party Politics Has Failed! Authored by John Halpin via The Liberal Patriot, National Politics Is A Graveyard It’s time to face reality: two-party politics has failed. Americans want more and better choices than the ones Republicans and Democrats currently provide. Whether the two-party system stands or gets radically transformed in the future remains an open question, however. As reported by Gallup, a record-high percentage of American adults at the end of 2025 self-identified as political independents, 45 percent, including majorities of both millennials and Generation Z plus a plurality of Generation X. In comparison, less than three in ten Americans self-identified as either a Republican or a Democrat in 2025, respectively. People who cling to a fading notion of partisanship often assert that political independence is a youthful phase and that people’s party affinities deepen with age. While this may have been true in the past, Gallup’s numbers challenge the notion going forward—political independence tops partisan identification among every age cohort born from 1965 on. The recent increase in independent identification is partly attributable to younger generations of Americans (millennials and Generation X) continuing to identify as independents at relatively high rates as they have gotten older. In contrast, older generations of Americans have been less likely to identify as independents over time. Generation Z, like previous generations before them when they were young, identify disproportionately as political independents. As political independence increases steadily, the desire for a major third party has also climbed. Sixty-two percent of American adults in 2025 said that a new party is needed compared to only three in ten adults who feel that the “Republican and Democratic parties do an adequate job of representing the American people.” In contrast, 56 percent of U.S. adults felt the two parties adequately represented Americans in 2003. The desire for a third party makes sense when you examine the sharp declines in public favorability towards both Republicans and Democrats. In the early 2000s, more than six in ten Americans held a favorable opinion of both parties at some point. By the end of 2025, only four in ten felt favorably about Republicans, and only 37 percent felt that way about Democrats. If you look at the trajectories of the last three presidential terms, Trump-Biden-Trump, you can see how disdain for partisanship plays out. In each instance, the incumbent party’s president lost overall public support rapidly as independent supporters sided with the opposition against the incumbent, leading to frequent switches in party control of both the Congress and the presidency. Trump and Republicans came into office in 2017 with unified control of government only to lose the House in 2018 and both the presidency and Senate after the 2020 election. Biden came into office in 2021 with unified control of Congress and promptly lost the House in 2022, and then Democrats lost both the presidency and the Senate in 2024. Trump again started his second term with unified control of government yet looks on track to at least lose the House in 2026. Who knows what will happen in 2028 at the end of the Trump era? Stability seems unlikely, however. Neither party seems capable of building nor sustaining durable national majorities. Republican and Democratic leaders and their policy programs are widely disliked by both political opponents and many independents, as they each pursue purely partisan objectives when in power that further polarize and alienate the electorate. Since voters are essentially forced to choose between two failed parties every cycle, the system chugs along with Americans growing increasingly cynical about government and politics. But if voters were offered an option beyond the two major parties, many Americans would gladly take it up. Given the amount of money and anger floating around…

Catch-Up Contributions: Maximizing Your Savings If You're Over 50 In 2026 And Beyond

Catch-Up Contributions: Maximizing Your Savings If You're Over 50 In 2026 And Beyond Authored by John Rampton Via The Epoch Times, If you’re over 50 and feel behind on retirement savings, you’re not alone—and you’re not out of options. There is a powerful tool that the government provides to help you close the gap: catch-up contributions. Ground Picture/Shutterstock This extra contribution is designed to help older workers boost their retirement savings during their peak earning years. Its importance has never been greater than it is today because of rising inflation, higher living costs, and longer life expectancies. In addition, the SECURE 2.0 Act (SECURE refers to Setting Every Community Up for Retirement Enhancement) has added more opportunities by 2025, especially for those between the ages of 60 and 63. Let’s take a look at what’s new, how much you can contribute, and what the updates mean for your retirement plan. Why Catch-Up Contributions Matter It is a struggle for many Americans to save enough for retirement. For people 55–64, the median retirement savings are $185,000, which is much lower than the $1.26 million “magic number.” A catch-up contribution gives you a chance to make up for lost time. If you started saving late, took time off work, or simply couldn’t save as much as you hoped, these contributions let you go beyond 401(k) and 403(b) limits. With the average life expectancy now in its 80s, a larger nest egg allows you to maintain your lifestyle, cover healthcare expenses, and reduce financial stress as you age. Standard Catch-Up Contribution Rules The Internal Revenue Service allows you to contribute more to your retirement accounts if you’re over 50. 401(k), 403(b), and similar plans. In 2025, you can contribute an additional $7,500. Individual Retirement Accounts (IRAs) (Traditional or Roth). An additional $1,000 can be added each year. If you’re over 50, you could contribute up to $31,000 to your 401(k) and $8,000 to your IRA in 2025, assuming you have the income and plan flexibility. In addition to boosting your savings, pre-tax contributions can also cut your taxable income or boost tax-free retirement income—if contributions are made to a Roth. What’s New in 2025: Key Retirement Contribution Limits Always check your plan details with your employer or plan administrator, as contribution limits and eligibility may vary. Standard Workplace Plan Limits Employee deferral limit. The maximum amount for 2025 is $23,500. Standard catch-up (Age over 50). For those 50 or older, an additional $7,500 can be contributed, bringing the total to $31,000. SECURE 2.0 ‘Super Catch-Up’ As a result of SECURE 2.0, retirees will experience a powerful—but temporary—boost. Who qualifies? Employees aged 60, 61, 62, or 63 in 2025. Limit. There is an enhanced catch-up of up to $11,250—the greater of $10,000 or 150 percent of the standard $7,500 limit. Total potential contribution. It’s possible to defer up to $34,750 in 2025, including $23,500 in standard deferral and $11,250 in super catch-up, if your plan allows it. Action step. Employers have the option of using this feature. Be sure to check with your HR department or plan administrator to confirm participation. This “super catch-up” gives late-career savers a rare chance to supercharge their savings in the final years before retirement. IRA Contribution Limits (Traditional & Roth) Standard IRA limit. The same as last year. Catch-up (Age over 50). Those 50 and older can contribute an additional $1,000, bringing the total contribution to $8,000. Even if you’re contributing to a workplace plan, adding to an IRA can increase your investment options and tax savings. Mandatory Roth Catch-Up for High Earners Some older workers will soon be able to make catch-up contributions under a new rule called SECURE 2.0. Who is Affected. Participants aged 50 or older and who earned more than $145,000 in Federal Insurance Contributions Act (FICA) wages from the employer in the previous…